Many companies are well on the way to recognising revenue from contracts with customers under an entirely new framework in line with AASB 15. The effective date of the new law was 1 January 2018, so your accounting systems, processes and contracts should now be catering for these changes. Our AASB 15 summary below explains the new standard, and our slide-share further down gives a quick explanation of the AASB five step model.

What is AASB 15 and how does it apply to your business?

AASB 15 applies to all contracts with customers, except for contracts covered by other Standards, such as leases, insurance and financial instruments. AASB 15 was introduced to harmonise with international reporting requirements, overcome weaknesses in the previous revenue standards, deliver more accurate commercial financial reporting and a single revenue recognition model for investors to understand and compare the revenue of different companies.

AASB 15 stipulates how and when revenue is recorded, requiring entities to provide users of financial statements with more information and reporting disclosures. Its core principle is the recognition of revenue for the transfer of goods or services, at a value that reflects the consideration to which the entity expects to be entitled, in return for meeting performance obligations.

Transition and effective date

AASB 15 mandatorily applies to annual reporting periods beginning on or after 1 January 2018, with your company’s year end determining the first period applicable:

| Your company year end: 31 December 30 June | First period applicable: 1 Jan-31 Dec 2018 1 July-30 June 2019 |

Who is most affected?

AASB 15 will have the most impact on businesses which involve:

- Bundled products and services

- Significant warranties/rebates

- Variability in revenue collectability from contract to contract

- Contracts where consideration varies

- Renegotiation of scope/consideration of contracts.

The five-step model to achieve AAS B15 requirements

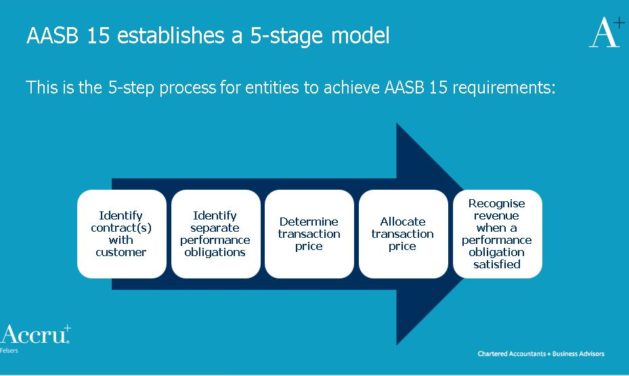

The new Standard establishes a five-stage model for entities to:

- Identify the contract with the customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognise revenue when (or as) the performance obligations are satisfied.

To understand the full impact of the AASB 15 on your business, customer contracts should be reassessed against the superseded standards and thefive-stage model. For a quick explanation of the 5 steps involved in this model, play the slide-share:

Essentially, an entity should evaluate the probability of receiving consideration in exchange for the goods or services provided, taking into account the customers’ ability and intention to pay (including discounts, rebates, refunds, price concessions, incentives and performance bonuses).

The transaction price should be allocated to the performance obligations based on the proportion of their relative stand-alone prices. Stand-alone price is the price at which an entity will sell the promised good or service separately to a customer.

Costs to fulfil a contract with a customer that are not within the scope of any other Standard are allowed to be capitalised and amortised.

Disclosure requirements

All entities reporting through general purpose financial statements should expect increased levels of disclosure.

Under AASB 15 disclosure objectives, an entity must disclose sufficient information to enable users of financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

See our article AASB 15 Revenue Recognition, 1 January 2018 for information about the disclosure requirements and other useful background.

Does your business need help with AASB implementation?

Companies who were well-prepared for AASB 15 would have adopted a transition approach – retrospective or cumulative effect – well before the effective date. However, some businesses may not have the necessary skills and resources inhouse for implementation.

Accru Felsers assists many clients with AASB implementation and the application of other Australian Accounting Standards. Please contact your local Accru advisor if you would like our help to ensure a smooth and compliant transition of your accounting systems.