Standards effective for the first time for June reporters

There are a number of new standards which are mandatorily effective for the first time on 30 June 2021, however we do not believe that the majority of them will have any significant impact for our clients.

A complete list is provided below; however we are going to focus only on three of these standards (marked with an *).

- AASB 2018-6 Amendments to Australian Accounting Standards – Definition of a business*

- AASB 2018-7 Amendments to Australian Accounting Standards – Definition of Material*

- AASB 1059 Service Concession Arrangements: Grantors

- AASB 2019 – 7 Amendments to Australian Accounting Standards – Disclosure of GFS Measures of Key Fiscal Aggregates and GAAP / GFS Reconciliations

- Conceptual Framework for Financial Reporting

- AASB 2019 -3 Amendments to Australian Accounting Standards – Interest Rate Benchmark Reform

- AASB 2019 – 5 Amendments to Australian Accounting Standards – Disclosure of the Effect of New IFRS Standards Not Yet Issued in Australia

- AASB 2020-4 Amendments to Australian Accounting Standards – COVID-19 Related Rent Concessions*

AASB 2018-6 Amendments to Australian Accounting Standards – Definition of a business

If an entity acquires a number of assets in a transaction, then it is important to consider whether the transaction involves the acquisition of assets or the acquisition of a business since the accounting implications are quite different.

The definition of a business has been amended and now requires an entity to consider what has been acquired based on whether there were previous outputs from the assets acquired (i.e. production of goods or services). If there were no previous outputs then in order for a business to exist then the acquirer must have acquired a workforce.

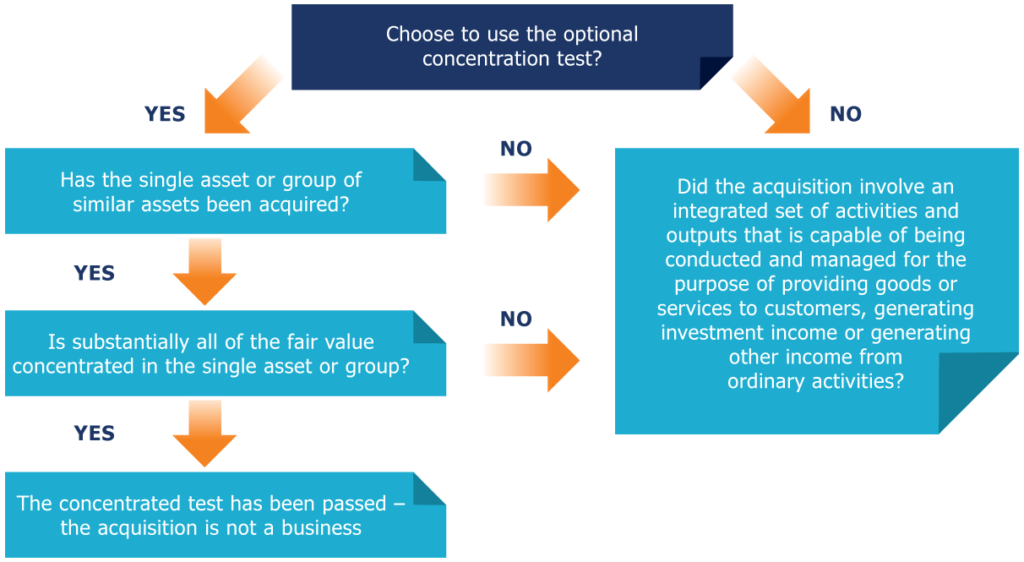

In addition, an optional concentration test has been introduced which allows an entity to consider whether significantly all of the fair value of the assets acquired is within one asset or a group of similar assets, the concentration test is illustrated below:

AASB 2018-7 Amendments to Australian Accounting Standards – Definition of Material

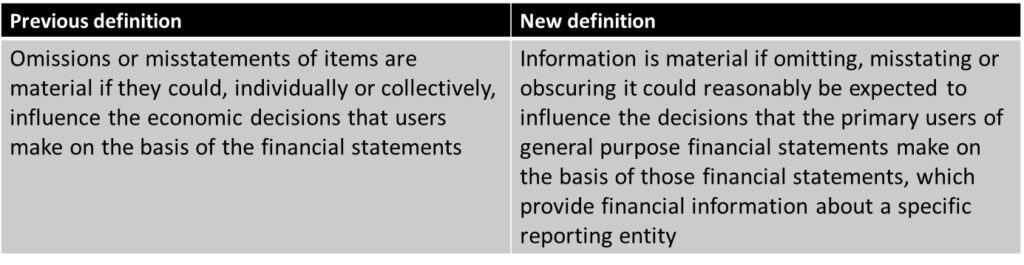

The definition of material in relation to financial reporting has been revised to the following:

COVID – still an issue for financial reporting?

This provides a great opportunity for entities to review their financial statements as they are being compiled to ensure that the information included is relevant to users and is not cluttered with immaterial information which obscures the useful information.

2021 is a better year than 2020 for most people and entities, however we are still seeing the impacts of COVID-19 globally and in Australia and therefore it is a good opportunity to remind entities of the financial reporting considerations in this area for the 30 June 2021 financial statements.

To disclose or not – we would expect to see some disclosure around the impact of COVID—19 in all financial statements on 30 June 2021. This disclosure should tell the story of how the pandemic has impacted your entity, whether positive, negative or not at all, the disclosures should be factual and include any key assumptions you have made in compiling the financial statements.

Impairment – impairment testing is required to be performed whenever there is an indicator of impairment and the existence of COVID-19 is likely to be an indicator of impairment for the majority of entities. This means that the recoverable amount of cash generating units will need to be determined and may result in write-downs of assets, in particular goodwill balances.

Anything else – we remind entities that COVID-19 may have impacted a range of balances and entities should understand changes in balances and transactions for 2021, for example employee leave entitlements, changes to lease term estimates, inventory levels and capacity limits for venues which may continue to affect revenue.

AASB 16 Leases – Year 2

Significant time and effort was spent by our clients in implementing the new leasing accounting standards.

We encourage all finance teams to speak to the staff responsible for managing leases within their organisations to identify all changes during the year to ensure that the correct accounting is applied.

Changes to the Australian Reporting Framework reminder

The November 2020 issue of this newsletter worked through in detail the changes to the framework and discussed the entities which would be affected.

We encourage our readers to review this newsletter which can be accessed by clicking here.

We have included additional information regarding the transition process here.

As a reminder there are certain entities currently preparing special purpose financial statements who will be required to transition to general purpose financial statements – the references to special purpose financial statements or SPFS below relates only to those entities.

In addition, entities who are currently preparing Tier 2 reduced disclosure general purpose financial statements (RDR) will need to transition to Tier 2 simplified disclosure general purpose financial statements in accordance with AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities.

We have previously discussed the incentives within the standards for early adoption and will summarise that information as well as other choices available to entities below.

Entities preparing RDR or SPFS which comply with recognition, measurement, consolidation and equity accounting requirements.

Note: we have used a 30 June reporting entity to illustrate the options and potential relief, all other reporting dates would be applicable to the reporting period after the June dates illustrated.

| Adoption Date | 30 June 2021 | 30 June 2022 |

|---|---|---|

| Changes to reported numbers | No | No |

| Changes to disclosures* | Yes | |

| Relief available: | ||

| Choose not to include comparative disclosures for disclosures not previously included in the financial statements | Yes | No |

* The changes in disclosures will vary depending on the disclosures included in the previous financial statements:

- Entities previously preparing RDR financial statements are likely to have an overall reduction in disclosures, although there are some additional disclosures, e.g. audit fees and imputation credits.

- Entities previously preparing SPFS may have an overall increase in disclosures, although some disclosures previously included are no longer required, for example standards issued not yet effective.

Entities preparing SPFS which do not comply with recognition, measurement, consolidation or equity accounting requirements.

The financial statements of these entities will see the most significant changes as the reported numbers will change.

There are two methods of transition:

- AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors – apply all standards as if they were adopted at the time that the transaction / balance was entered into. This is complex since it requires consideration of amendments to the standards since the inception date.

- AASB 1 First-time Adoption of Australian Accounting Standards – apply all standards in place at the end of the current reporting period at the opening balance sheet date (1 July 2020 for June reporters) with certain mandatory and voluntary exceptions. This approach provides more flexibility and will likely involves less time and effort.

| Adoption date | 30 June 2021 | 30 June 2022 |

|---|---|---|

| Changes to reported numbers | Yes | Yes |

| Changes to disclosures* | Yes | |

| Transition options | AASB 1 or AASB 108 | AASB 1 or AASB 108 |

| Relief available: | ||

| Choose not to restate comparative figure instead present those which were previously presented | Yes | No |

| Choose not to distinguish between errors and changes in accounting policies where previously stated compliance was not correct | Yes | No |

| Choose not to include comparative disclosures for disclosures not previously included in the financial statements | Yes | No |

"

"