The cost of fuel is a significant outlay for many businesses. With fuel prices set to increase, it is important to know whether your business is eligible to claim tax credits.

Businesses can claim fuel tax credits for the tax (excise or customs duty) that’s included in the price of fuel when fuel is used for machinery, plant, equipment, heavy vehicles and light vehicles travelling off public roads.

To be eligible, your business must be registered for Goods & Services Tax (GST) and fuel tax credits with the Australian Taxation Office (ATO). If your business is already registered for GST, you can add a registration for fuel tax credits at any time without it affecting the GST tax period (monthly, quarterly, annual).

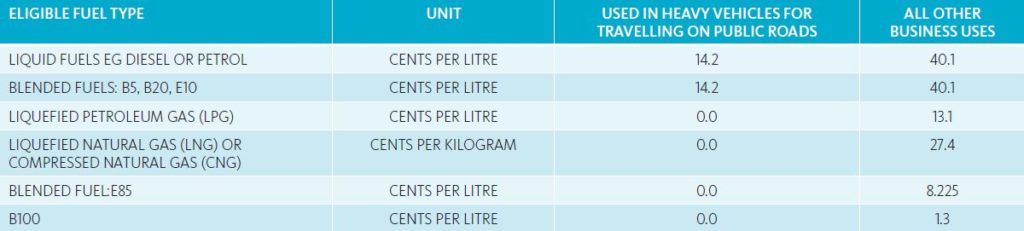

To calculate your business’s eligible fuel tax credit, first determine the type of fuel used and the type of business activity it was used for. Eligible fuels include petrol, diesel, kerosene and LPG. Fuel used in light vehicles of 4.5 tonnes or less travelling on public roads are ineligible. The ATO publishes a fuel tax credit table with eligible fuel types along with the cents per litre that can be claimed. This is updated every February and August in line with the consumer price index (CPI). Once you have worked out the fuel tax credit amount, it should be reported on your Business activity statement (BAS).

We recommend complete and accurate records are kept to substantiate any fuel tax credit claim. For claims of less than $10,000 per year acceptable records can include bank statements, point-of-sale dockets or fuel supplier statements. More detailed record keeping is required if your business exceeds the $10,000 threshold.

Rates for fuel acquired from 1 February 2017 to 30 June 2017

If you would like to know more about Fuel Tax Credits and if your business may be eligible please contact your local Accru office for further information.