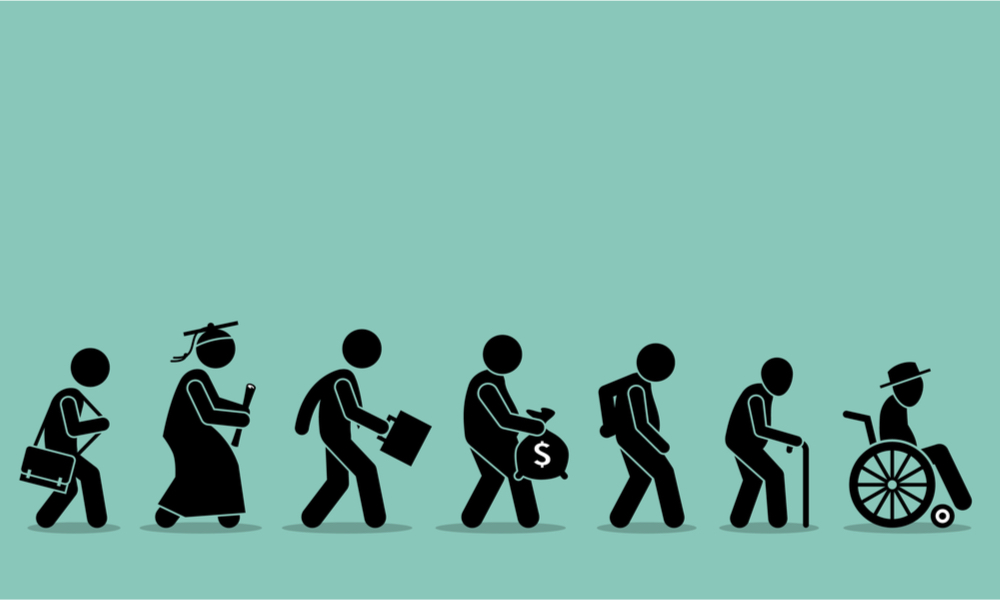

There are many common events that people go through throughout their life that result in the need to update or change their financial plans. These can be both positive and negative events which, if plans are put in place, can have a large impact on the ability to save for the future.

Retirement

This is a key life event that all working people strive towards and is often not considered until retirement is fast approaching. Retirement planning can be made easier if undertaken well before your anticipated retirement date. With sufficient time, strategies such as maximising super contributions, or reducing insurance coverage if costs outweigh the benefits, can have a significant impact on the balance of your retirement savings.

Family Changes

Whether it be marriage, divorce, changes in a de facto relationship, or having kids, it is important to understand that your personal financial position has changed. Through marriage or having children your family is growing and potentially your financial commitments to the people around you is growing as well. Having the right insurances in place, such as life/TPD or income protection, is an example of looking after the people around you by planning for the unexpected. Future planning for expenses such as day care or school fees can be factored into the budgeting process. Separation through divorce will also result in your financial plans significantly changing. Your previous partner may have been the ‘bread winner’ and therefore your income may have dropped significantly. To cope as well as possible, a financial planner can help you put in place strategies to ensure you are confident you are financially self-sufficient.

Inheritance

The unfortunate loss of a family member can result in lump sum payments or assets being passed on to other family members. There may be tax implications to consider and questions as to what do with the money. A financial planner can help you understand what you have inherited – it might be significant shares, for example – and what to do with funds.

Planning for your own death and what you will leave as an inheritance for family requires an up-to-date Will. Seeing a legal professional and consulting with a financial planner regarding how you want to structure your own estate can save your family undue stress in the event of your death. Communicating your wishes to family before your passing can also prevent family tensions or estate disputes.

There are many other changes throughout life that may result in the need to seek financial advice. These may include buying or selling your home, job changes, illness or disability and aged care needs. It is important to understand that being proactive and seeking advice early can have far greater outcomes than waiting until it may be too late. Talk to your local Accru Financial Planner to see how we can help you understand and plan for your financial outcomes.