We are pleased to present the December 2024 edition of Financial Reporting Update, in this edition we will look at:

- The new standards for 31 December 2024 including some examples on the current / non-current requirements

- The AASB proposals for NFP financial reporting

- A sustainability update

- An update on ACNC related party information

- Contemporary issues

New standards reminders

The new standards for 31 December 2024 with a brief description of the changes are included below:

| New Accounting Standard | Changes | Likely Level of Impact |

| AASB 101 Presentation of Financial Statements– current / non-current classification of liabilities | Amendments to the definition of a current liabilitySpecific guidance on breaches of covenants on long-term borrowings and waivers / periods of graceAdditional disclosures for covenants tested after the reporting period. | Some entities may change the classification of long-term loans between current and non-current. See examples below the table for illustrations of the changes. |

| AASB 2022-5 Amendments to Australian Accounting Standards – Lease Liability in a Sale and Leaseback | Provides clarify on subsequent measurement of sale and leaseback arrangements where the sale meets the criteria in AASB 15 Revenue from Contracts with Customers to be treated as a genuine sale.Requires the seller-lessee to measure the lease liability from the leaseback in a way that avoids recognising any gain or loss related to the right of use they keep. | May affect reported numbers on sale and leaseback. Refer to the information in the contemporary issue section of this newsletter relating to sale and leaseback transactions. |

| AASB 2023-1 Amendments to Australian Accounting Standards – Supplier Finance Arrangements (AASB 2024-1 is Tier 2 version) | Requires additional disclosures where entities have supplier financial arrangements in place.Supplier finance arrangements is where a finance provider pays a company’s suppliers on its behalf. The company then repays the finance provider either on the original invoice due date or at a later date, based on the terms of the arrangement. These arrangements can benefit the company by giving it more time to pay, or they can benefit suppliers by allowing them to be paid earlier than usual. These arrangements are also known as supply chain finance, payables finance, or reverse factoring | These clarifications are unlikely to require significant changes for NFP public sector entities, however the additional guidance should be reviewed to confirm that the methodology used is appropriate. |

| AASB 2022-10 Amendments to Australian Accounting – Fair Value Measurement of Non-Financial Assets of Not-For-Profit Public Sector Entities | Provides clarity to not-for-profit public sector entities in relation to measurement of fair value for non-cash generating assets.Restricts the need to perform the highest and best use to specific circumstanceProvides clarity around when an entity can use their own assumptions as a proxy for those of a market participant.Includes additional guidance for determining the replacement cost of an asset. | Unlikely to have significant impact, however public sector entities should review their fair value methodology to confirm compliance with AASB 13. |

The new requirements discussed above in relation to classifying liabilities mean you need to look carefully at loan agreements, covenants, waivers, and breaches. We have included some additional guidance below.

Timing is everything

If you breach a covenant but get a waiver from the lender before the reporting date, the loan is able to be split between current and non-current. However, if the waiver comes after the reporting date, it is too late for the accounting standard—the loan is current at the reporting date.

Example 1:

Entity A has a loan covenant requiring a debt-to-equity ratio of less than 2:1.

At reporting date (31 December 2024), Entity A breaches this covenant. However, since the entity was monitoring compliance on a regular basis, they requested and received a written waiver from the lender in December 2024 which allowed the entity to disregard the covenant requirement at reporting date.

Classification: The liability is classified as non-current because the waiver was received before the reporting date, granting the company the right to defer settlement at that date.

Example 2:

Entity B breaches a covenant at its reporting date of 31 December 2024 but did not realise until January 2025. It obtains a waiver from the lender in January 2025.

Classification: The liability is classified as current because Entity B did not have the right to defer settlement at the reporting date and cannot use the benefit of hindsight. The issue of the waiver would be disclosed as a non-adjusting event after the reporting period.

Example 3:

Entity C has a 31 December 2024 reporting date and a loan due for repayment on 1 March 2025. On 15 January 2025 they negotiate an extension with the financial institution to extend the repayment date by three years.

Classification: The liability is current because the refinancing agreement was not in place at the reporting date. The renegotiated loan facility would be disclosed as a non-adjusting event after the reporting period.

AASB proposes significant changes for NFP financial reporting

The AASB has released two important exposure drafts as part of their project to simplify financial reporting for not-for-profit (NFP) entities.

ED 334: Limiting the Ability of NFP entities to Prepare Special Purpose Financial Statements proposes requiring private sector NFP entities to prepare general purpose financial statements (GPFS) if they meet either of the following conditions:

- The entity is required by legislation to prepare financial statements in compliance with Australian Accounting Standards or accounting standards or

- The entity’s constituting or other documents (such as a bank agreement or trust deed) require financial statements to be prepared in accordance with Australian Accounting Standards.

Existing constituting documents will be grandfathered, meaning only new or amended documents, from a date to be determined, will trigger the requirement to prepare GPFS.

This change will significantly increase the number of NFP entities, including all medium and large charities registered with the ACNC, that must prepare GPFS.

ED 335: General Purpose Financial Statements – Not-for-Profit Private Sector Tier 3 entities proposes a simplified framework for recognition, measurement, and disclosures tailored specifically for certain NFP entities.

This Tier 3 accounting standard will be presented as a stand-alone standard, introducing easier-to-apply recognition and measurement requirements.

The balance sheet and income statement under the Tier 3 framework will differ from those under existing accounting standards.

The application of this standard is still subject to further guidance, with regulators like the ACNC yet to confirm which entities will qualify.

The AASB is inviting feedback on these exposure drafts until 28 February 2025, and we encourage all our NFP clients to review the proposals and participate in the consultation process. This can be done by attending one of the AASB’s outreach events or completing their feedback survey.

Further details and resources are available on the AASB website: Developing a Simpler Reporting Framework for NFP Entities

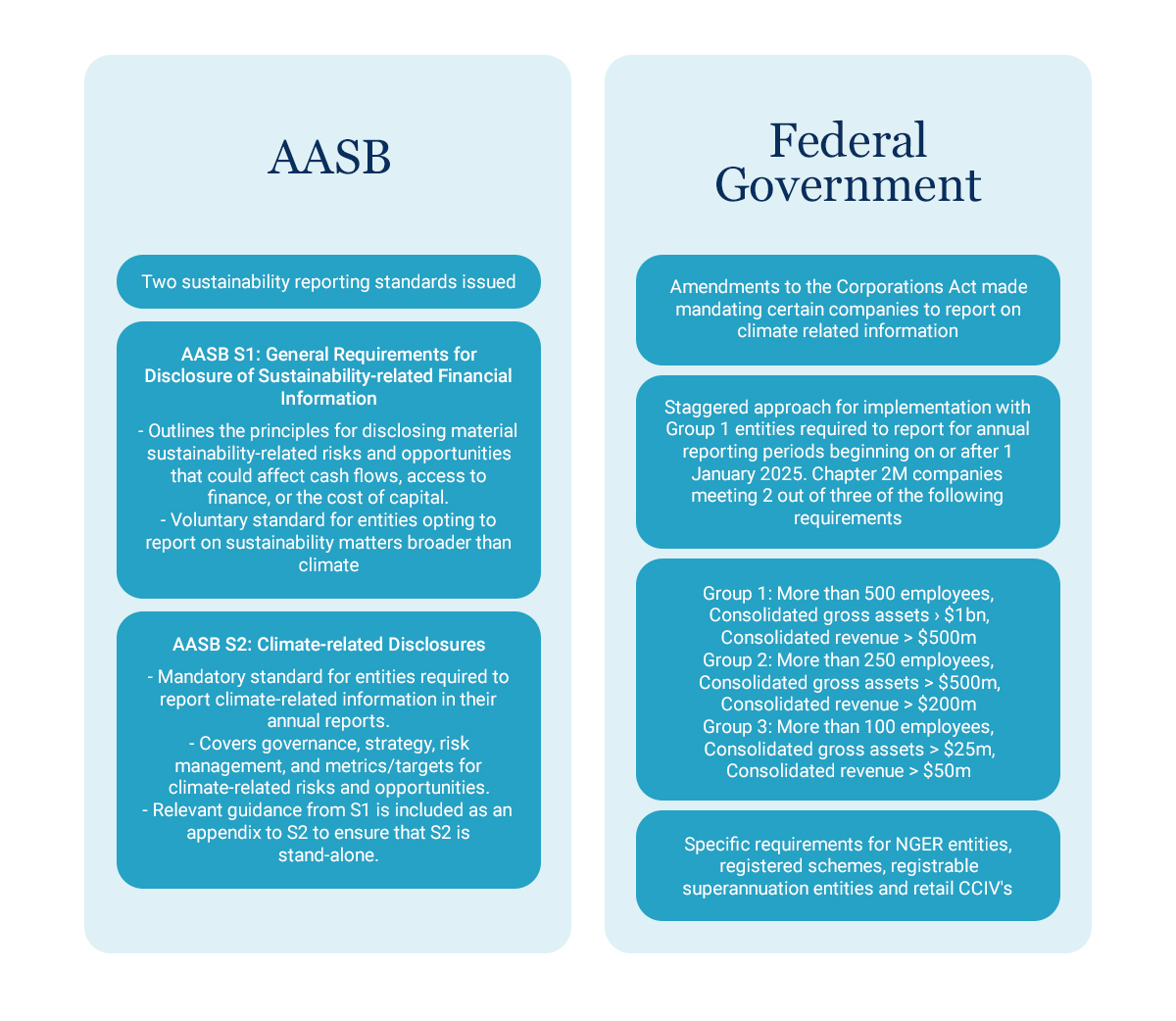

Sustainability update

The previous issues of this newsletter have provided details regarding the key players for climate-related reporting in financial statements in Australia and the progress to date, we now have much more certainty around this project as discussed below.

Your to do list:

- Assess Reporting Obligations:

Determine whether your organisation falls under the mandatory climate reporting requirements based on size thresholds or other criteria. Notwithstanding the mandated thresholds, entities should also consider:- If your organisation markets itself with a focus on climate responsibility or sustainability, then voluntarily including climate related information in your annual report reinforces your commitment.

- If your organisation is part of an international group, your overseas parent may require sustainability disclosures for their consolidated reporting. Start discussing these needs to ensure you’re prepared.

- Prepare Systems and Processes:

If mandatory reporting applies, start evaluating your existing systems and processes. Ensure they can capture and report the necessary data effectively. - Consider Supply Chain Implications:

Even if your organisation isn’t directly subject to the new requirements, you may need to support reporting for larger entities in your value chain by providing Scope 3 carbon emissions data. Begin discussions with key customers or suppliers to understand their expectations.

Australian Charities and Not-for-profits Commission (ACNC) related party information

The ACNC has given some best practice recommendations in relation to related party disclosures in financial statements of medium and large charities which we encourage our clients to follow:

- If your charity has no related party transactions to report, the ACNC recommends including a statement such as:

“There are no related party transactions to disclose for the reporting period.” - Where your charity has no remunerated KMP, a best practice note might state:

“No key management personnel received remuneration during the reporting period.” - Where a large charity preparing Special Purpose Financial Statements (SPFS) has only one remunerated KMP, and uses the exemption provided by the ACNC, it is recommended to include a note such as:

“The charity has only one remunerated key management personnel under the exemption provided by the ACNC, remuneration has not been disclosed. “

The inclusion of these statement shows users of the financial statements that the omission is intentional and not an oversight and reduces the risk of queries or concerns about these disclosures.

Contemporary issues

Sale and leaseback

The new standards for 31 December 2024 include a clarification regarding accounting treatment for a sale and leaseback and this provides a timely opportunity for a reminder that there may be a difference between a legal agreement showing a sale and leaseback and the accounting treatment for the transaction.

A transaction may qualify as a sale legally but fail to meet the criteria for an accounting sale under AASB 15 Revenue from Contracts with Customers.

If an entity is considering entering into a sale and leaseback transaction, then some accounting considerations include:

- Does the Transaction Meet the Accounting Definition of a Sale?

- For the sale to qualify under AASB 15, control of the asset must transfer to the buyer. This means the buyer has the ability to direct the use of the asset and obtain the majority of its benefits.

- Clauses That Could Cause a Failed Sale:

- Repurchase Options: the seller-lessee retains the right to repurchase the asset at a future date.

- Significant Continuing Involvement: the seller-lessee continues to control or restrict the buyer’s ability to use the asset

- Leaseback Terms: there are leaseback conditions, such as fixed low rental payments that effectively transfer ownership-like benefits back to the seller-lessee.

- Impact of a Failed Sale:

- If the transaction does not meet the definition of a sale, the asset remains on the seller-lessee’s balance sheet, and the proceeds are recorded as a financing liability rather than revenue. Further there is no recorded gain / loss on sale.

If you want any more information on any of the topics discussed in this newsletter or to discuss the application to your specific circumstances, please get in touch with your local Accru representative.

"

"