Large disasters don’t occur regularly but smaller events like power outages and delayed supplier deliveries do. These disruptions can mean lost revenue and extra expenses. Insurance won’t cover them all, nor replace customers who switch to the competition.

Business continuity planning is all about envisioning what your business could do to reduce costs, downtime and keep your customers satisfied, should the worst happen. With the vast array of technology and digital data businesses now depend on, it has become even more important.

In a large disruptive event, like an earthquake or destructive flood that destroys your building, a solid business continuity plan could actually mean the difference between whether your business recovers, or is one that simply can’t recoup the losses and goes under.

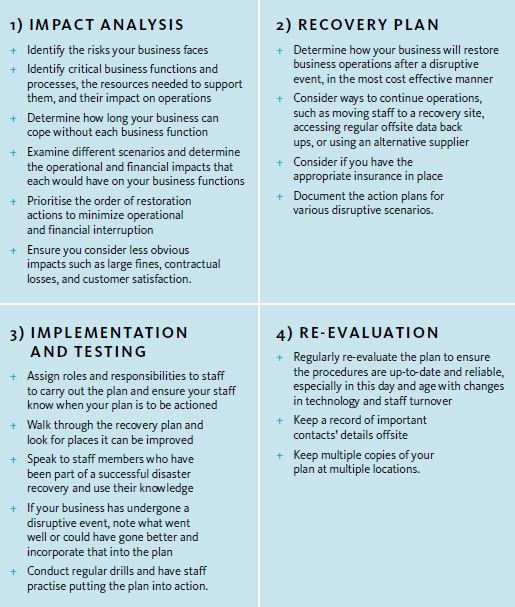

Developing and executing a business continuity plan involves the four key steps outlined below. As well as business impact analysis and prioritised recovery plan, regular testing and exercises are needed to ensure your recovery strategies will work.

If you need assistance with creating a business continuity plan, or wish to discuss your plan with an experienced advisor, please contact your local Accru Office.