Executive summary

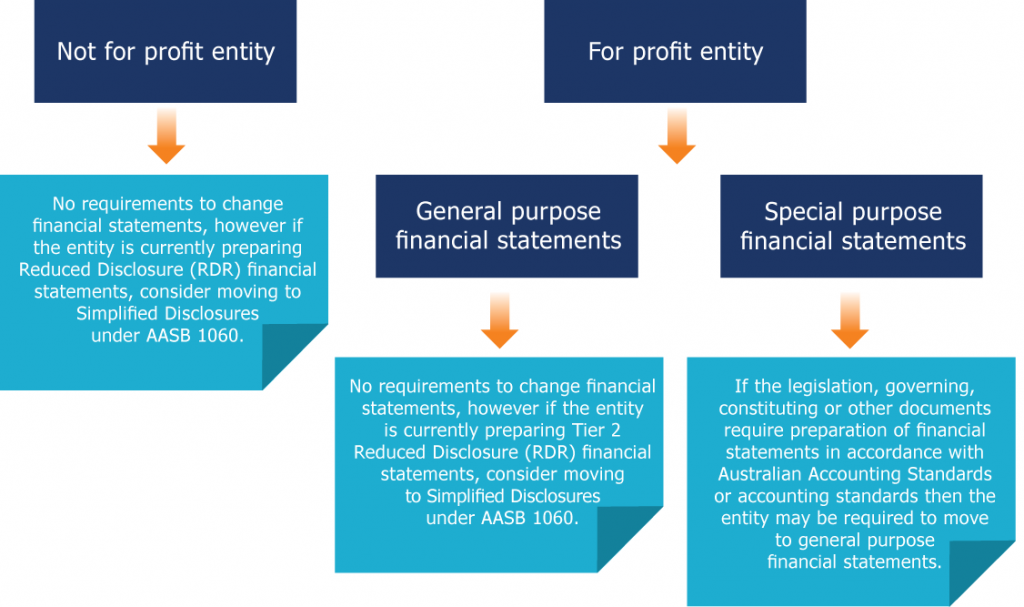

An entity’s impact is determined by the type of entity, the relevant governing documents, relevant legislation and the financial statements currently being prepared as illustrated in the diagram below:

The sections below explore these concepts in more detail.

Background

The reporting entity concept which allows Australian entities to self-assess the content of their financial statements through their determination of existence of users enabling preparation of general or special purpose financial statements is being overhauled.

The AASB is providing a more robust framework specifying that requirements to prepare financial statements which comply with Australian Accounting Standards (or accounting standards) mean general purpose financial statements as described below.

The framework for for-profit entities has been completed through the release of AASB 2020-2 Amendments to Australian Accounting Standards – Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities, however the not-for-profit entity framework is a work in progress.

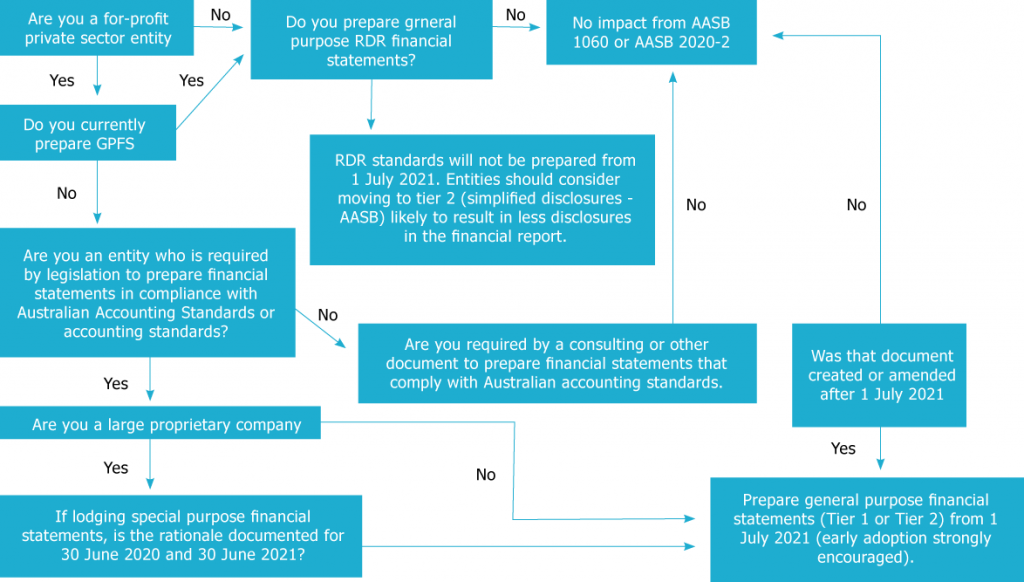

The flowchart below provides a summary of AASB 2020-2

Entities currently preparing general purpose financial statements

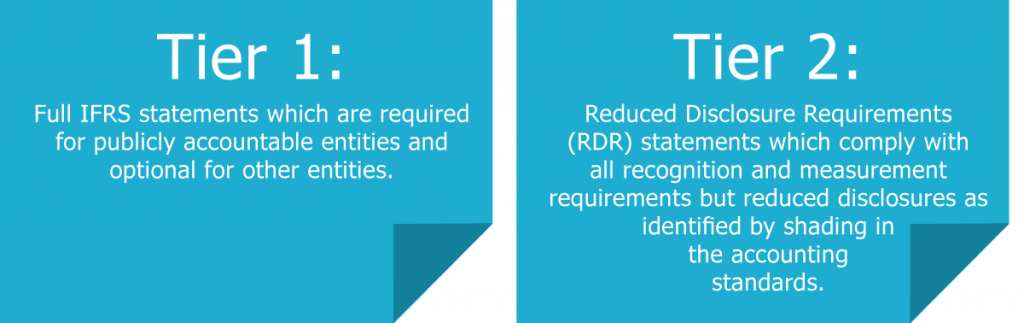

There are currently two tiers of general purpose financial statements in Australia:

There are no changes to Tier 1 reports, however Tier 2 disclosure requirements are now included in a stand-alone standard AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities and the RDR shading will not be maintained after 1 July 2021.

AASB 1060 disclosures are shown in relevant sections relating to the balance or transaction and are lower than the RDR disclosures and therefore entities currently preparing RDR financials should consider transitioning to AASB 1060 to provide more meaningful disclosures under the new regime and save time in the year end process.

There are some additional disclosures under AASB 1060, for example audit fees and imputation credits although generally the level of disclosure is lower under the simplified disclosure standard.

Entities currently preparing special purpose financial statements

The biggest impact under these changes affects for-profit entities currently preparing special purpose financial statements.

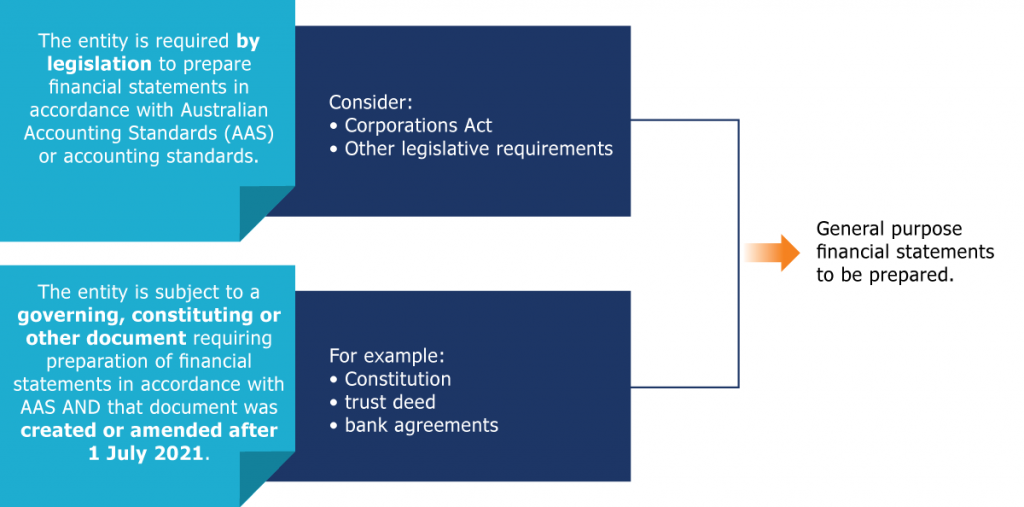

The choice for entities about whether to prepare general purpose or special purpose financial statements has been removed where either of the following is relevant:

This means that all companies preparing financial statements under chapter 2M of the Corporations Act (e.g. large proprietary companies, small foreign owned companies, Trustee companies controlling a large trust) and all Australian Financial Services Licence (AFSL) holders will be preparing general purpose financial statements.

All other entities, including Trusts, will need to review their relevant legislation, constitution or any other relevant document (e.g. trust deed, bank agreements) to determine whether they are captured. For example a trust whose Trust deed was set up or amended after 1 July 2021 which includes the following requirement, ‘the trust shall prepare financial statements in accordance with Australian Accounting Standards’ will need to prepare general purpose financial statements.

Level of impact

The level of impact for an entity will depend on whether they are currently complying with all recognition and measurement requirements (including consolidation) in the accounting standards.

If they are complying then the changes are purely disclosure changes.

If the entity is NOT complying with all recognition and measurement, for example:

- leases are not on balance sheet;

- employee benefit provisions are not recorded;

- deferred tax accounting not being applied;

- consolidation not being performed

then potentially significant adjustments to accounting policies will need to occur and the process will be time consuming.

Timeline

These changes become mandatorily effective for annual reporting periods beginning on or after 1 July 2021 (i.e. 30 June 2022), however entities should consider early adoption due to the transition relief being provided. This relief is illustrated below for 30 June and 31 December reporters.

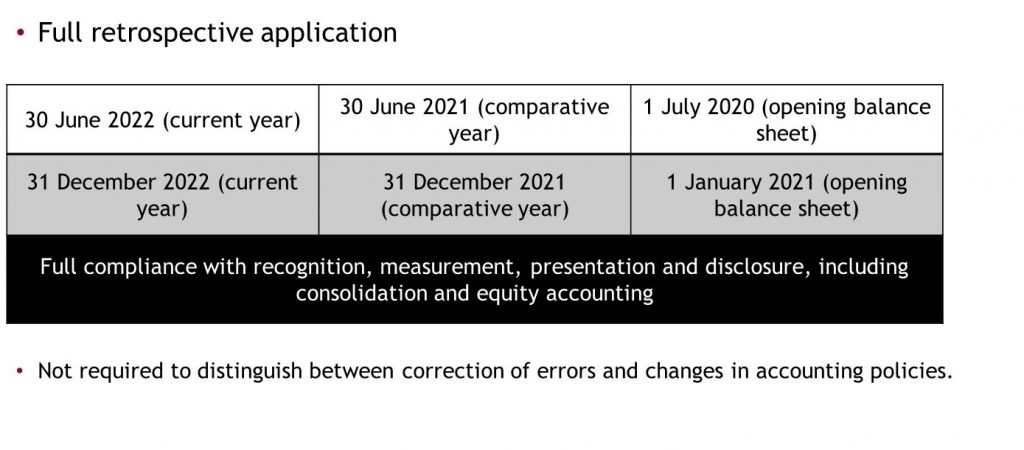

Adoption at the effective date (30 June 2022)

The financial statements for 30 June 2022 will be prepared on a fully retrospective basis, i.e. the opening balance sheet of the comparative period (1 July 2020) and the comparative year 30 June 2021 will need to show compliance with all recognition and measurement and consolidation rules.

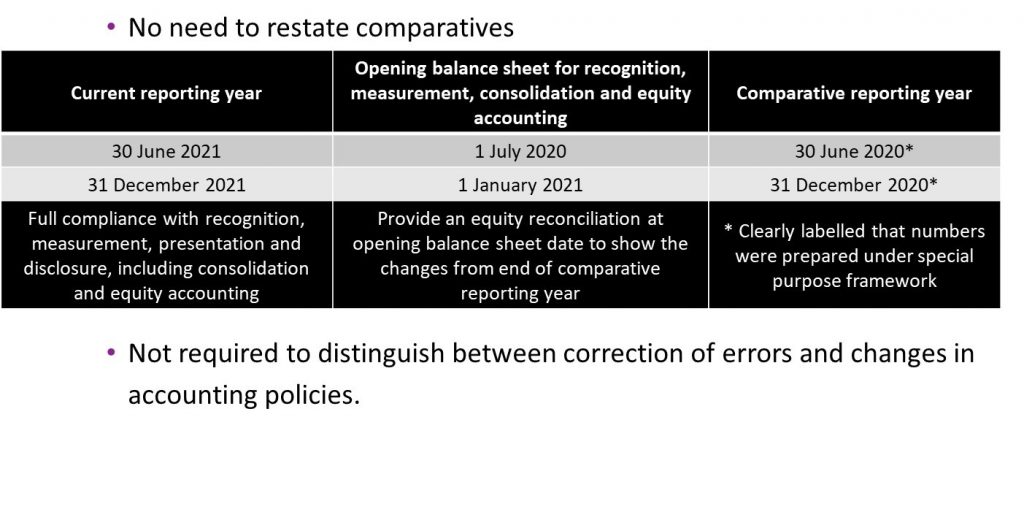

Early adoption at 30 June 2021

The standard provides an exemption from restating comparatives and the opening balance sheet for the adjustments will be the beginning of the current period (i.e. 1 July 2020).

Both scenarios require the same opening balance sheet, i.e. date when full recognition, measurement and consolidation is required however if early adoption is chosen then there is no restatement of comparative year and therefore much less work.

Action items

Review relevant legislation, constitution and other documents to understand your requirements for preparing financial statements under Australian Accounting Standards.

If your current trust deed, constitution, bank agreement etc refers to Australian Accounting Standards then consider discussions with the relevant counterparties to change the documents to remove the reference. As noted above, if any change occur to these documents after 1 July 2021 and the reference to Australian Accounting Standards is retained then the entity is required to prepare general purpose financial statements.

Having considered the overview above, if you believe that your current financial statements will need to change, please contact your Accru representative who will be pleased to work through the options for you and assist you with identifying the changes to be made.

"

"