Many businesses face a common financial challenge – they have mountains of financial data but not in a form that provides an accurate financial picture of their business or helps them make sound business decisions. Used effectively, business intelligence (BI) software is helping to change this as our article Business Intelligence – a game changer for SMEs explained.

Accru has been able to assist many companies to become more profitable by structuring and analysing their financial data using the latest BI tools and advising on the implications revealed. We look at one example below.

Understanding the business

Infoplus Australia* is a software business that generates its revenue primarily from three products. One product, developed internally, had only recently been launched when Accru was engaged. The company also generates a substantial amount of revenue through ticket sales to an annual industry event which it organises and promotes. Infoplus, although a successful young company, had some key concerns:

- Inability to accurately measure profitability by product and to direct the focus of its marketing activity accordingly

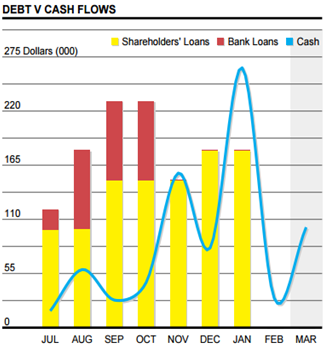

- Major cash flow issues, largely due to the lag between incurring annual event expenses and receiving ticket payments

- Holding onto excess cash instead of paying off bank and shareholder loans due to cash flow uncertainties, resulting in high interest payments

- Not knowing if, when and how much the company could afford to pay in shareholders’ dividends

Accru helped Infoplus address these issues, resulting in increased profit and a more focused marketing strategy. Here’s how.

Identifying opportunities for sales and growth

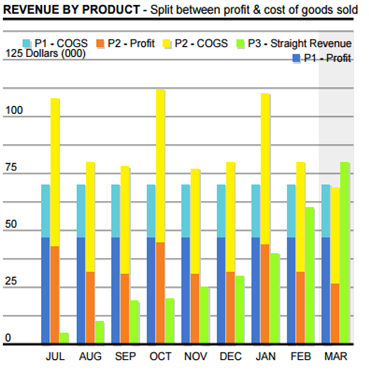

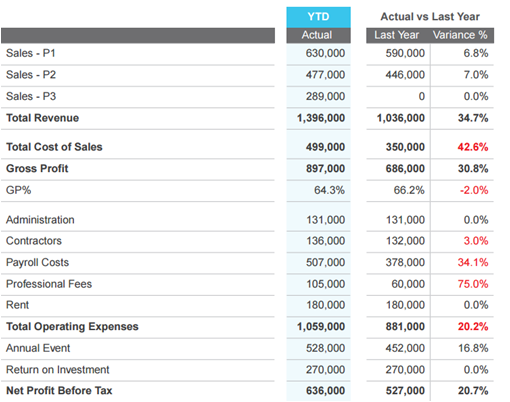

Infoplus’s payroll costs were not recognised as a cost of sale for each product in their existing financial reports. We made the recommendation to assign payroll costs to particular products, which provided a more accurate picture of product profitability and revealed that Product 1 was the most profitable despite lower revenue figures. We advised Infoplus to focus on this product and went further, using Power BI software to identify suburbs with the highest and lowest sales to better inform their marketing strategy.

Identifying areas for savings

Once costs had been assigned to individual products, the data revealed that wages costs for Product 3, the newly launched product, were excessive and impacting its profitability. On investigation, we found this was largely due to contractors fees. While contractors had been necessary in the product development phase, transferring them to employees was a far more cost-effective way to retain them for ongoing product support. Our advice resulted in saving thousands of dollars annually.

Stabilising cash flow fluctuations

Utilising the latest software to accurately project and graph future cash flow, debt and profitability, we were able put in place a strategy to free up cash without affecting business operations. For example, we could accurately forecast the amount of cash needed to be kept aside for specific times of year, and advised on the best time to make loan repayments and dividends so that excess cash didn’t need to be tied up year round.

The financial results

Because of the cost savings made in the above areas and others, there was in fact money to pay the directors their first ever dividend within a year.

This is just one example of the many strategies that can be used to give our clients’ businesses a boost. Please contact us if you would like to know more or see more ways to give your business a boost.

*Infoplus is a fictional client. Any resemblance to a real entity is unintended. The work and results mentioned here are based on a conflation of actual work done for various Accru Felsers clients.