n these uncertain times, we have gathered below the main Australian government support initiatives that can assist your business.

Please note that this space evolves at a rapid pace, and some of the more recently added initiatives could be still in the form of a proposal, or with no legislation or concrete guidance available at this time.

The following is based on our current understanding and discussions with the various Government bodies.

Update 12 October 2020 – please refer to sections in purple for recent changes.

Federal support:

- JobKeeper Subsidy

- JobKeeper Extension [UPDATED]

- Cash Flow Support

- SME Guarantee Scheme

- SME Simple Access to Credit

- Apprentices & Trainees Support

- Apprentices & Trainees Support Extension

- PAYG Instalments Variations

- ATO Tax payment deferrals

- ATO Tax lodgment deferrals

- Instant asset write-off

- Accelerated depreciation

- Assistance for severely affected regions

- Fringe Benefits Tax – Widening of emergency relief exemption

- Australian forced presence – ATO not to investigate non-compliance

- Significant Global Entities – Concessions

State/Territory support:

Non-Governmental support:

Federal Support

JobKeeper Subsidy

- Eligibility is restricted to employers that:

- Register with the ATO before the end of the relevant fortnight – the due date for the 30 March to 2 April fortnight is extended to 31 May;

- Are not subject to the Major Bank Levy;

- Advise their employees that they have been nominated as eligible employees for the subsidy; and

- Have aggregated global turnover of:

- < $1b, with a drop in GST turnover in their month or quarter of more than 30% compared to the prior year; or

- ≥ $1b, with a drop in GST turnover in their month or quarter of more than 50% compared to the prior year.

- Alternate tests have been implemented for businesses that have in the last 12 months been:

- Established;

- Acquired;

- Disposed of;

- Restructured;

- Experiencing substantially increased turnover;

- Affected by a natural disaster or drought;

- Irregular in generating turnover; or

- A sole trader or small partnership with sickness, injury or leave.

- A subsidy of up to $1,500 per fortnight will be received for each employee that:

- Is currently employed;

- Was already employed as at 1 March 2020 (1 July 2020 for fortnights starting after 3 August 2020);

- Is employed full-time, part-time, or has been employed on a regular basis since prior to 1 March 2019;

- Is at least 16 years old;

- Is either:

- an Australian citizen;

- an Australian permanent resident;

- a New Zealand citizen that qualifies as an Australian tax resident;

- a New Zealand citizen that has been residing continuously in Australia for 10 years or more; or

- on a protected special category visa;

- Is not already in receipt of the JobKeeper Payment from another employer; and

- Provides a nomination notice confirming the above.

- If your employee’s fortnightly wages (excl. super) are:

- Less than $1,500, the subsidy will cover the wage, and you will be required to pay the shortfall (with no super payable on that shortfall) – you have until 31 August 2020 for top-up on employees hired between 2 March 2020 and 1 July 2020;

- More than $1,500, the subsidy will only cover $1,500.

- Businesses without employees (incl. sole traders) can be eligible if they satisfy the above and:

- Are actively engaged in the business;

- Had an ABN as at 12 March 2020; and

- Made supplies between 1 July 2018 and 12 March 2020 and reported on them to the ATO by 12 March 2020

- Businesses that fail the drop in turnover test (e.g. new businesses) with no comparable prior year must ask for the ATO to exercise their discretion as for eligibility.

- The subsidy will last from 30 March 2020 to 27 September (where eligible). The first payments will be released in early May.

- Only one director per company can receive JobKeeper on their director’s fees.

- Only one shareholder per company that is paid remuneration in the form of dividends can receive JobKeeper.

- Back-payments of wages or of the shortfall on the $1,500 are allowed for the first 2 fortnights, including where employees had originally been stood down – but only if paid by 8 May 2020.

- Warning: This arrangement might be detrimental on your short-term cashflow for low-pay employees. Indeed, you will need to pay them now more than before (the shortfall on the $1,500), and will need to wait until May to receive the subsidy amount back.

- Scam alert: ‘Fill this form to register your business’. This is not law yet, and will take some time to be put in effect. We advise to be wary of scam emails and only access forms through official websites.

JobKeeper Extension

- Eligibility is restricted to employers that:

- Qualify under the previous JobKeeper restrictions, meaning employers that:

- Register with the ATO before the end of the relevant fortnight;

- Are not subject to the Major Bank Levy;

- Advise their employees that they have been nominated as eligible employees for the subsidy; and

- For eligibility in the December 2020 quarter, have aggregated global turnover of:

- < $1b, with a drop in GST turnover in the September 2020 quarter of more than 30% compared to the prior year; or

- ≥ $1b, with a drop in GST turnover in the September 2020 quarter of more than 50% compared to the prior year.

- For eligibility in the March 2021 quarter, have aggregated global turnover of:

- < $1b, with a drop in GST turnover in the December 2020 quarter of more than 30% compared to the prior year; or

- ≥ $1b, with a drop in GST turnover in the December 2020 quarter of more than 50% compared to the prior year.

- Qualify under the previous JobKeeper restrictions, meaning employers that:

- Alternate tests have been released, providing a similar treatment to the alternate tests under the standard JobKeeper subsidy. A new alternate test was introduced for businesses temporally ceased. These alternate tests are fairly complex, so please reach out if you need assistance to test eligibility under these.

- Eligibility for the subsidy needs to be tested anew each quarter (28 September 2020 to 3 January 2021, 4 January 2021 to 28 March 2021).

- Subsidies are only still receivable for an employee that:

- Is currently employed;

- Was already employed as at 1 July 2020;

- Is employed full-time, part-time, or has been employed on a regular basis since prior to 1 March 2019;

- Is at least 16 years old;

- Is either:

- an Australian citizen;

- an Australian permanent resident;

- a New Zealand citizen that qualifies as an Australian tax resident;

- a New Zealand citizen that has been residing continuously in Australia for 10 years or more; or

- on a protected special category visa;

- Is not already in receipt of the JobKeeper Payment from another employer; and

- Provides a nomination notice confirming the above.

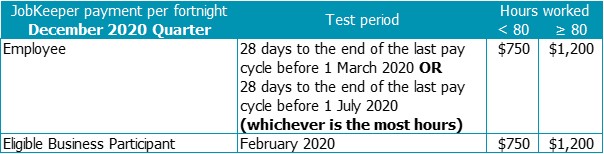

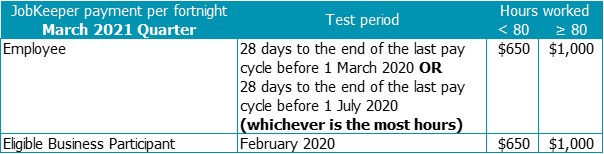

- JobKeeper payment rates for employees and business participants are as follow:

- If your employee’s fortnightly wages (excl. super) are:

- Less than the relevant payment rate, the subsidy will cover the wage, and you will be required to pay the shortfall (with no super payable on that shortfall) – you have until 31 October 2020 for top-up on the October 2020 wages;

- More the relevant payment rate, the subsidy will only cover the relevant payment rate.

- Businesses without employees (incl. sole traders) can be eligible if they satisfy the above and:

- Are actively engaged in the business;

- Had an ABN as at 12 March 2020; and

- Made supplies between 1 July 2018 and 12 March 2020 and reported on them to the ATO by 12 March 2020

- Businesses that fail the drop in turnover test (e.g. new businesses) with no comparable prior year must ask for the ATO to exercise their discretion as for eligibility.

- Only one director per company can receive JobKeeper, and only if they are not employed by another employer as a part-time/full-time employee.

- Only one shareholder per company can receive JobKeeper, and only if they are not employed by another employer as a part-time/full-time employee.

- No need for re-enrolment or to re-assess employees’ eligibility if already claiming JobKeeper 1.0.

- Turnover must be calculated using the same Cash/Accrual method as used when reporting GST to the ATO.

Cash Flow Support

- Eligibility will require all of the following:

- You qualify under one of these:

- you reported as a small business entity in their last lodged income tax return;

- you would have reported as a small business entity in their last lodged income tax return, if the aggregated turnover threshold had been $50m at the time;

- you had global aggregated turnover of $50m or less in the last financial year; or

- you will reasonably have global aggregated turnover of $50m or less in the current financial year.

- You report to the ATO on wages and withholding in relation to any period between March and June 2020.

- You had an ABN as at 12 March 2020.

- You made supplies between 1 July 2018 and 12 March 2020 and reported on them to the ATO by 12 March 2020. New alternate tests have been introduced for businesses that did not lodge their 2019 Income Tax Return or a 2018-2020 Business Activity statement by then.

- You qualify under one of these:

Please note that the ATO might request evidence of your eligibility.

- Quarterly PAYG withholders will receive back:

- March Activity Statement – 100% of the March PAYG withholding.

- June Activity Statement – 50% of the March + 150% of the June PAYG withholding.

- September Activity Statement – 50% of the March + 50% of the June PAYG withholding.

- Monthly PAYG withholders will receive back:

- March Activity Statement – 300% of the March PAYG withholding.

- April Activity Statement – 100% of the April PAYG withholding.

- May Activity Statement – 100% of the May PAYG withholding.

- June Activity Statement – 75% of the March + 25% of the April + 25% of the May + 125% of the June PAYG withholding.

- July to September Activity Statements – 75% of the March + 25% of the April + 25% of the May + 25% of the June PAYG withholding.

- A Minimum credit of $10,000 will be received by all employers when lodging their March Activity Statement. Additional minimum credits of $5,000 will be received by all employers when lodging their June & September Activity Statements.

- Only the first $50,000 of PAYG Withholding can be considered for claiming the above credits. As a result, the maximum credits that can be claimed total $100,000.

- Refunds will be received only when the above-mentioned credit results in an overall credit balance with the ATO and all your tax lodgments are up-to-date. You can either still pay your full Activity Statement and receive a refund or only pay the net amount.

- Myth: ‘I can reduce the tax withheld on my employees’ salaries’. This is an incentive to support businesses in retaining staff, not a reduction in the PAYG you must withhold on the employees’ salaries. The Government will announce additional measures to support employees this weekend.

- Scam alert: ‘Fill this form to register your business’. The ATO will determine the eligibility, calculate the credit, and process the refund where available, so no application is required.

SME Guarantee Scheme

- Eligibility is restricted to businesses with global aggregated turnover of $50m or less in the 2020 or 2019 financial year. To apply for this scheme, contact a participating bank. Funds need to be used toward supporting working capital.

- 50% of the value of new unsecured loans will be guaranteed by the government.

- Total covered loans are capped at $250,000 per borrower.

- No repayment will be required during the initial 6 months.

- A second phase on new loans will start from 1 October 2020 until 30 June 2021.

SME Simple Access to Credit

- Eligibility is restricted to businesses with global aggregated turnover of $50m or less in the 2020 or 2019 financial year. Funds need to be used for business purposes.

- 6-month exemption from all responsible lending obligations when applying for any form of credit.

Apprentices & Trainees Support

- Eligibility is restricted to businesses that employ less than 20 Full-Time Equivalent employees. An Australian Apprenticeship Support Network (AASN) provider will determine the eligibility. Applications will run from early April.

- A subsidy of 50% of apprentices and trainees’ wages can be reimbursed for the period of January to September 2020, up to $7,000 per quarter per employer.

Apprentices & Trainees Support Extension

- Eligibility is restricted to businesses that employ less than 200 Full-Time Equivalent employees. An Australian Apprenticeship Support Network (AASN) provider will determine the eligibility. Applications will run from July 2020 for small businesses (less that 20 employees) and from October 2020 for other employers, up to June 2021.

- A subsidy of 50% of apprentices and trainees’ wages can be reimbursed for the period of July 2020 to March 2021, up to $7,000 per quarter per employer.

PAYG Instalments Variations

- All taxpayers are eligible.

- Cashflow relief is possible by varying PAYG income tax instalments. The ATO will allow all eligible taxpayers to vary their estimated tax for the year to $nil (regardless of actual tax). This will allow taxpayers to claim back any instalment paid in the September or December 2019 quarters.

- Warning: This is a temporary relief. A reduction in your tax instalments might mean a much larger tax payment required with your 2020 Income Tax Return.

- Warning: Franking accounts in companies are replenished by the payment of income tax. Do consider your dividend franking needs before varying your income tax instalments.

ATO Tax payment deferrals

- Eligibility will be automatic, but you must still call the ATO to request the deferral.

- Cashflow relief is possible by deferring the payment of all liabilities that came about after 12 March 2020. The new due date for payment will be 14 September 2020.

- Myth: ‘I can defer my lodgment due date easily’. Lodgments are still required by their original due dates. If you wish for a deferral, you will need to apply and detail your circumstances.

- Myth: ‘I can defer outstanding liabilities from before 12 March 2020’. All previous liabilities retain their due dates. If you wish for a deferral or a payment arrangement plan, you will need to apply and detail your circumstances.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 14 September 2020.

ATO Tax lodgment deferrals

- Companies with original due dates of 15 May 2020 are now due for lodgment and payment on 5 June 2020.

- Self-Managed Superannuation Funds with original due dates of 15 May 2020 are now due for lodgment and payment on 30 June 2020.

- Fringe Benefits Tax Returns with original due dates of 21 May 2020 are now due on 25 June 2020. Payment due dates have also been deferred to 25 June 2020.

Instant asset write-off

- Eligibility is restricted to businesses with global aggregated turnover of $500m or less in the 2020 or 2019 financial year. No application is required.

- Cashflow relief is possible by claiming upfront the full depreciation of assets:

- Costing up to $150k each

- First used or installed and ready for use between 12 March 2020 and 31 December 2020.

Accelerated depreciation

- Eligibility is restricted to businesses with global aggregated turnover of $500m or less in the:

- 2020 or 2019 financial year for claims in the 2020 financial year;

- 2021 or 2020 financial year for claims in the 2021 financial year.

- Cashflow relief is possible by claiming upfront 50% of the depreciable cost of assets first used or installed and ready for use between 12 March 2020 and 30 June 2021.

- Myth: ‘I can claim both the instant asset write-off and the accelerated depreciation’. The accelerated depreciation is meant to assist businesses for assets that are ineligible under the other incentive.

Assistance for severely affected regions

- Government discretionary assistance will be provided through existing or new mechanisms.

Fringe Benefits Tax – Widening of emergency relief exemption

- Providing accommodation, meals or transport to employees is generally subject to Fringe Benefits Tax. The ATO will treat these benefits as exempt under the emergency relief provisions, if the assistance is in relation to COVID-19, to relocate an employee from a high-risk area, return them to their home, or when they are required to self-isolate.

Australian forced presence – ATO not to investigate non-compliance

- Central management and control of companies is a trigger for the Australian tax residency of a company. It is usually determined by where directors are physically located when making governance decisions (e.g. board meetings). Where board meetings are currently held with directors in Australia purely because of COVID-19, the ATO has declared that they will not apply compliance resources to determine if your central management and control is in Australia.

- Permanent establishment is the presence of staff in Australia, which can trigger exposure to Australian tax for a business (branch operations). Where your business only triggers a permanent establishment because of COVID-19, the ATO has declared that they will not apply compliance resources to determine if your business triggers a permanent establishment in Australia.

Significant Global Entities (SGE) – ATO concessions

- SGE penalties will be remitted for late lodgments of documents due between 23 January and 31 May 2020, if the delay is caused by COVID-19 and the documents are lodged within 30 days of the due date.

State/Territory Support

Australian Capital Territory

- Payroll Tax Deferral

- Eligibility will be restricted to businesses with payroll below $10m.

- Cashflow relief will be possible by deferring the payment of Payroll Tax Returns until 1 July 2022. This measure only starts from 1 July 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 1 July 2022.

- Payroll Tax Waiver

- Eligibility is restricted to the hospitality, creative arts, entertainment and prohibited (e.g. gyms, cinemas..) industries.

- A full exemption from payroll tax will be granted for the months of April 2020 to September 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Electricity Rebate

- Eligibility will be restricted to businesses with electricity usage below 100 MW.

- A rebate of $750 will be automatically applied to your next bill.

New South Wales

- Small Business Grant (expired)

- Eligibility is limited to businesses with:

- between 1 and 19 employees;

- turnover > $75k ;

- Australian wages (incl. super and fringe benefits) < $900k;

- an ABN as at 1 March 2020;

- employees as at 1 March 2020; and

- a high impact from the 30 March 2020 NSW Public Health Order (that restricted gathering and movement, and ordered the closure of certain premises), meaning a drop of at least 75% of turnover for a fortnight, in comparison to 2019.

- A grant of up to $10k will be given to eligible businesses that apply by 30 June 2020 and can provide appropriate documentation.

- Eligibility is limited to businesses with:

- Small Business Recovery Grant (expired)

- Eligibility is limited to businesses with:

- between 1 and 19 employees;

- turnover > $75k ;

- Australian wages (incl. super and fringe benefits) < $900k;

- an ABN as at 1 March 2020;

- employees as at 1 March 2020;

- activity in an industry highly impacted by the 30 March 2020 NSW Public Health Order (that restricted gathering and movement, and ordered the closure of certain premises); and

- a drop of at least 30% of turnover for a fortnight between March and July 2020, in comparison to 2019.

- A grant of up to $3k will be given to eligible businesses that apply between 1 July and 16 August 2020 and can provide appropriate documentation.

- Eligibility is limited to businesses with:

- No Payroll Tax on JobKeeper top-up

- Any top-up payment to reach the $1,500 per fortnight will not be taxable wages for Payroll Tax purposes.

- Myth: ‘The whole $1,500 is exempt’. You will still need to pay payroll tax on wages that are not a top-up payment.

- Payroll Tax Deferral

- Eligibility will be automatic for businesses with Australian wages (incl. super and fringe benefits) of up to $10m.

- Cashflow relief is possible by deferring the payment of March to September Payroll Tax Returns. The new due date for payment will be in October 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 3 August 2020.

- 2020 Payroll Tax Relief (past period)

- Eligibility will be automatic for businesses with Australian wages of up to $10m.

- A 25% reduction in annual tax liability will be applied.

- City of Sydney Small Business Grant (expired)

- Eligibility is limited to businesses with:

- operations based within the City of Sydney;

- between 1 and 19 employees as at 1 March 2020;

- turnover < $10m ;

- an ABN as at 1 March 2020.

- A grant of up to $10k will be given to eligible businesses that apply by 27 April 2020 and can provide appropriate documentation.

- The funds are limited to use in altering the business to overcome COVID-19 circumstances.

- Eligibility is limited to businesses with:

- 2020 Land Tax Relief

- Eligibility is limited to owners of land leased to:

- a commercial tenant with annual turnover of up to $50m experiencing a drop in turnover of at least 30%; or

- a residential tenant experiencing a drop in household income of at least 25%.

- A reduction of up to 25% in the 2020 land tax on a property will be applied where this reduction is passed to the tenant as a reduction in rent.

- Eligibility is limited to owners of land leased to:

Queensland

- Payroll Tax Refund/Holiday (Small employers) (past period)

- Eligibility is restricted to businesses with up to $6.5m of Australian wages (incl. super and fringe benefits). Businesses that have not been emailed to advise of their eligibility can apply through this form by 31 May 2020.

- No payroll tax will be payable for November 2019 to March 2020, resulting in a refund of any tax paid for that period.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Payroll Tax Refund (Large employers) (past period)

- Eligibility is restricted to businesses with more than $6.5m of Australian wages (incl. super and fringe benefits) whose turnover has been negatively affected by COVID-19. Businesses can apply through this form by 31 May 2020.

- No payroll tax will be payable for January & February 2020, resulting in a refund of any tax paid for that period.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Payroll Tax Deferral

- Eligibility is restricted to businesses with up to $6.5m of Australian wages (incl. super and fringe benefits), unless their turnover has been negatively affected by COVID-19. Businesses that have not been emailed to advise of their eligibility can apply through this form.

- Cashflow relief is possible by deferring the payment of January to December 2020 Payroll Tax Returns (including the annual return). The new due date for payment will be 14 January 2021.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 14 January 2021.

- No Payroll Tax on JobKeeper

- The portion of wages that is subsidised by JobKeeper will not be taxable wages for Payroll Tax purposes.

- Jobs Support Loans

- Eligibility will be determined by the Queensland Rural and Industry Development Authority, likely based on need and impact on staff retention. You can register your interest using the contact details listed here.

- A loan of up to $250k can be sought, with an initial 12-month interest-free period.

- Electricity Rebate

- Eligibility will be restricted to businesses with electricity usage below 100 MW.

- A rebate of $500 will be automatically applied to your next bill.

- Land Tax Relief

- Eligibility is limited to owners of land leased to:

- a commercial tenant with annual turnover of up to $50m experiencing a drop in turnover ; or

- a residential tenant experiencing a drop in household income.

- A reduction of up to 25% in the 2020 land tax on a property will be applied where this reduction is passed to the tenant as a reduction in rent.

- The land tax foreign surcharge is also waived for all landholders for the 2020 year.

- Eligibility is limited to owners of land leased to:

South Australia

- Payroll Tax Waiver

- Eligibility will be automatic for businesses with Australian wages (incl. super and fringe benefits) of up to $4m.

- No payroll tax will be payable for the April to September 2020 Payroll Tax Returns (including the annual return).

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Payroll Tax Deferral

- Eligibility will be conditional on the ability to demonstrate a significant cash flow impact from COVID-19.

- Cashflow relief is possible by deferring the payment of April to September 2020 Payroll Tax Returns (including the annual return) until October 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by October 2020.

- No Payroll Tax on JobKeeper

- The portion of wages that is subsidised by JobKeeper will not be taxable wages for Payroll Tax purposes.

- Land Tax Deferral

- Eligibility will be automatic.

- Cashflow relief is possible by deferring the payment of any outstanding Land Tax liability for the 2019-2020 period for 6 months.

- Warning: This is a temporary relief. You will still need to pay the liabilities by October 2020.

- Liquor license fees waved

- Establishments forced to close will be not be required to pay their fees for 2020-2021.

Tasmania

Victoria

- Payroll Tax Waiver

- Eligibility is restricted to the hospitality, tourism and seafood industries. Other businesses with payrolls up to $5m can apply for their individual circumstances to be considered.

- A full exemption from payroll tax will be granted for the months of April to June 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- No Payroll Tax on JobKeeper

- The portion of wages that is subsidised by JobKeeper will not be taxable wages for Payroll Tax purposes.

- Small Business Loans

- Eligibility is restricted to businesses with turnover of up to $5m in the hospitality, tourism, seafood and exports industries. The funds must be used to purchase equipment or restructure business operations.

- A 3-year interest-free loan can be sought.

- Apprenticeships & Traineeships Grants

- Eligibility will be restricted to small businesses in the hospitality, tourism, building, construction and manufacturing industries .

- A $5,000 grant will be offered.

- 2021 Land Tax Waiver

- Eligibility will be restricted to commercial properties where the business was affected by COVID-19.

- A full exemption from land tax will be granted for the 2020-2021 financial year.

- Water & Electricity Bills Waiver

- Eligibility will be restricted to businesses on Tariffs 22, 94, 82 or 75.

- No fees will be payable on the first quarterly bill issued after 1 April 2020.

- 2020 Payroll Tax Exemption & Refund (past period)

- Eligibility will be automatic for businesses with Victorian taxable wages (incl. super and fringe benefits) of up to $3m.

- No payroll tax will be payable for the year ended 30 June 2020.

- A refund will automatically be given for any payroll tax paid to date for the year.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Payroll Tax Deferral

- Eligibility will be automatic for businesses with Victorian taxable wages (incl. super and fringe benefits) of up to $10m.

- Cashflow relief is possible by deferring the payment of the July 2020 to June 2021 Payroll Tax Returns. The new due dates for payment will be staggered starting with 7 September 2021.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 1 January 2021.

- No Payroll Tax on JobKeeper top-up

- Any top-up payment to reach the $1,500 per fortnight will not be taxable wages for Payroll Tax purposes.

- Myth: ‘The whole $1,500 is exempt’. You will still need to pay payroll tax on wages that are not a top-up payment.

- 2020 Land Tax Deferral

- Eligibility is limited to owners of at least 1 non-residential property, with total taxable land holdings below $1m.

- Cashflow relief is possible by deferring the payment of the 2020 Land Tax until 31 March 2021.

- Warning: This is a temporary relief. You will still need to pay the liabilities.

- City of Melbourne Business Grants (expired)

- Eligibility is limited to businesses with:

- operations based within the City of Melbourne;

- between 1 and 50 employees as at 1 March 2020;

- an ABN as at 1 March 2020.

- Grant of $2k (training), $5k (online platforms) and $10k (capital works) will be given to eligible businesses that apply online and can provide appropriate documentation.

- The funds are limited to use in altering the business to overcome COVID-19 circumstances.

- Eligibility is limited to businesses with:

- Local Lockdown’s Business Support Program (expired)

- Eligibility is limited to businesses with:

- operations based within postcodes affected by the 30 June 2020 Stay at Home order;

- payroll between $1 and $3m per annum;

- GST registration;

- an operating business as at 16 march 2020; and

- an ABN as at 16 March 2020.

- Grant of $5k will be given to eligible businesses that applied before 31 July 2020 and can provide appropriate documentation.

- Eligibility is limited to businesses with:

- Business Support Fund #3

- Eligibility is limited to Victorian businesses with:

- operations subject to an industry restriction of Restricted, Heavily Restricted or Closed;

- no easing in industry restriction levels between the First and Second Steps of Victoria’s roadmad to reopening

- participation in the JobKeeper subsidy;

- employees;

- a registration with WorkSafe Victoria;

- 2019-2020 payroll of up to $10m per annum;

- GST registration as at 13 September 2020;

- an ABN as at 13 September 2020.

- Grants of $10k, $15k or $20k will be given to eligible businesses of respective payrolls of up to $650k, $3m and $10m, if applied before 23 November 2020 and can provide appropriate documentation.

- Eligibility is limited to Victorian businesses with:

- Sole Trader Support Fund

- Eligibility is limited to Victorian businesses with:

- operations from commercial premises;

- operations subject to an industry restriction of Restricted, Heavily Restricted or Closed;

- no easing in industry restriction levels between the First and Second Steps of Victoria’s roadmad to reopening

- participation in the JobKeeper subsidy;

- no employees;

- GST registration as at 13 September 2020;

- an ABN as at 13 September 2020.

- A grants of $3k will be given to eligible businesses that apply before 23 November 2020 and can provide appropriate documentation.

- Eligibility is limited to Victorian businesses with:

- Other Funds (Licensed Hospitality businesses, Alpine businesses, Business Chambers and Trader Groups, Outdoor Eating and Entertainment)

- 2020 Land Tax Relief

- Eligibility is limited to owners of land leased to:

- a commercial tenant with annual turnover of up to $50m experiencing a drop in turnover ; or

- a residential tenant experiencing a drop in household income.

- A reduction of up to 25% in the 2020 land tax on a property will be applied where this reduction is passed to the tenant as a reduction in rent.

- A payment deferral on the remainder of the 2020 land tax can obtained until 31 March 2021. Payments to date can be claimed back.

- Eligibility is limited to owners of land leased to:

Western Australia

- 2020 Payroll Tax Grant (past period)

- Eligibility will be restricted to businesses paying payroll tax that have Australian taxable wages (incl. super and fringe benefits) between $1m and $4m. No application is required, as the grant will be paid automatically.

- A one-off grant of $17,500 will be issued.

- 2020 Payroll Tax Waiver (past period)

- Eligibility is automatic for businesses with up to $5m of Australian wages (incl. super and fringe benefits) at 29 February 2020.

- A full exemption from payroll tax will be granted for the months of March to June 2020.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- 2020 Payroll Tax Deferral (past period)

- Eligibility is restricted to employers failing the Waiver eligibility test, but expecting less than $7.5m of Australian wages for the 2020 Payroll year.

- Cashflow relief is possible by deferring the payment of March to June Payroll Tax Returns (including the annual return) until 21 July 2020.

- A full waiver of the March to June Payroll Tax will be granted if Australian wages for the 2020 Payroll year are less than $7.5m.

- Myth: ‘I don’t need to lodge Payroll Tax Returns’. You will still need to lodge your monthly Payroll Tax Returns on time.

- Warning: This is a temporary relief. You will still need to pay the liabilities by 21 July 2020.

- No Payroll Tax on JobKeeper

- The portion of wages that is subsidised by JobKeeper will not be taxable wages for Payroll Tax purposes.

- Electricity Rebate

- Eligibility will be restricted to businesses with electricity usage below 50 MW.

- A rebate of $2,500 will be automatically applied to your next bill.

Non-Governmental Support

Australian Bank Association (ABA) – Small Business Relief

- Eligibility is limited to current business customers with less than $3m of debt to all credit providers, and not in arrears as of 1 January 2020. You simply need to advise the bank that you have been impacted by COVID-19 (no proof necessary).

- Loan repayments can be deferred for 6 months if your banks is an ABA member.

- Warning: This is a temporary relief. Your loan payments will still be payable at the end of the deferral period, and interest keeps accruing.

As you can surmise from the above, there are a lot of different support programs being announced, with little details on the eligibility criteria or practical application process. Things are evolving quickly and through many various channels, but we will do our best to keep you updated as we uncover more information.

If you wish to discuss your situation or would like our assistance applying for any of the above support, please reach out to your tax adviser.