The end of the financial year is rapidly approaching and there have been recent changes to the instant asset write-off rules which have the potential to impact businesses and there year-end spending.

As part of the federal budget handed down on 2 April 2019, changes to the Instant Asset Write-Off were announced. These changes increased the instant asset threshold and extended which businesses could access these measures. On 6 April 2019, these changes became law.

Am I eligible?

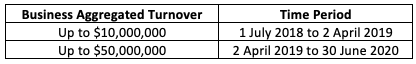

That depends on the aggregated turnover of your business. The table below identifies the relevant aggregated turnover thresholds:

If your turnover is less than $10,000,000 and you want to access the instant asset write-off, then all the simplified depreciation rules must be applied. Under the simplified depreciation rules, all depreciable assets (over the instant asset write-off threshold) are allocated to a general pool and the pool is depreciated at a flat rate of 30% per year (15% for the first year). All your depreciating assets must be allocated to the pool.

If your turnover is between $10,000,001 and $50,000,000, the instant asset write-off is available however the general depreciation rules apply for your other depreciable assets.

When considering turnover, it is important to note that it is based on your aggregated turnover. This can be a very technical area but in simple terms, this means your aggregate turnover of any entity connected (controlled) with you and any entity that is an affiliate. We recommend that you consult your Accru advisor when determining your aggregated turnover.

The amount that can be written-off

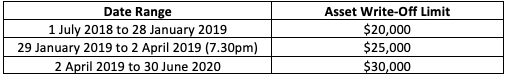

The maximum instant asset write-off is dependent on the date the asset was purchased. The table below details the asset write-off dates and maximum write-off value:

The asset write-off limit applies on an individual asset basis. As a result, if you have multiple assets that cost less than the write-off limit, all the assets can be written-off. As an example, if you had two assets that cost $19,500 each, both assets can be written-off.

The asset must be first used or installed ready for use in the year that you intend to claim the instant asset write-off. Any private-use portion will reduce the amount to be written-off.

If you are registered for GST, the asset write-off limit is on a GST exclusive basis. The entire cost of the asset must be less than the limit. For example, trade-ins are ignored when determining the cost of the asset.

These changes are expected to benefit millions of small businesses. To ensure you understand the changes to the law and are not missing out on the instant asset write-off changes, contact your local Accru office.