2022 was a year filled with disruption and change. Covid locked downs around the world were dismantled, central banks began to raise interest rates to fight the rising threat of inflation, and Russia commenced a war against the Ukraine with Western powers being drawn in to support sovereignty and freedom. The era of lower for longer interest rates and cheap money is now in the rear visions mirror, and this makes projecting future outcomes very challenging as earnings, spending, and valuations are adversely affected by higher inflation and interest rates.

This economic uncertainty was reflected in the share market returns for 2022. The MSCI All Country World Index fell -19.8%, the S&P 500 Index declined -19.4% and China’s Shanghai Composite dropped -15.1%. Domestically, the Australian S&P/ASX 200 Index outperformed its global peers, but still declined -5.5% thanks in large part of the ASX 200 weighting towards the big miners and banks coupled with the indexes relatively smaller exposure to technology companies.

In the financial planning landscape we are always dealing with uncertainties that try to disrupt the financial strategies we have put in place for our clients. Trying to achieve specific goals and objectives, income targets and return benchmarks becomes very challenging in an environment where stocks and bonds decline at the same time.

This article will cover several strategies that can be considered to help to navigate the uncertain and volatile economic times we are currently experiencing.

General advice warning

The information in this article is general in nature. It does not take your specific needs or circumstances into consideration, so you should look at your own financial position, objectives and requirements and seek financial advice before making any financial decisions.

Strategies

Dollar cost averaging

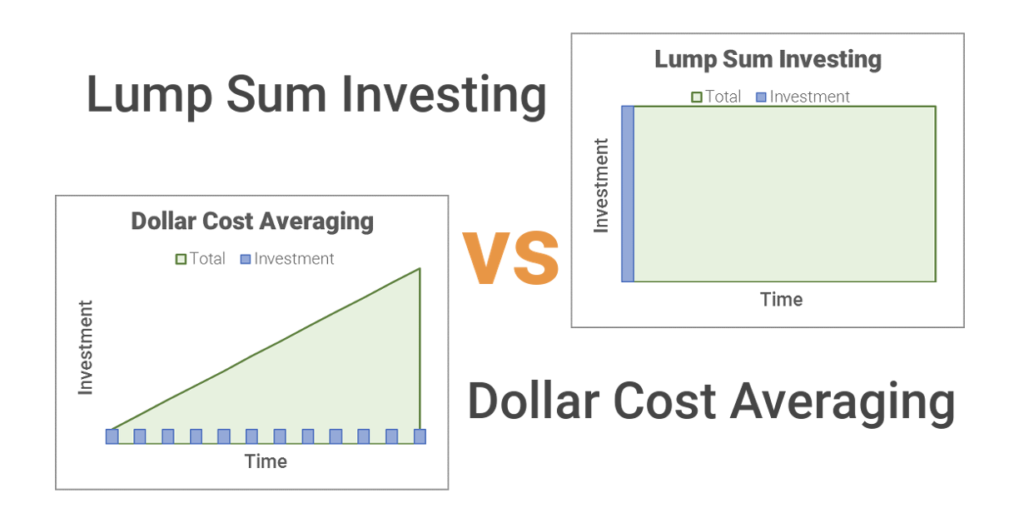

Dollar cost averaging involves investing a set amount of money at regular intervals. By investing this way you are not attempting to pick the lows or highs of the market but rather investing a fixed dollar amount regardless of investment market trends.

By regularly investing in an investment market, you are not relying on timing strategies aimed at picking when a market has bottomed or peaked. Dollar cost averaging imposes a helpful investment discipline by completely ignoring timing issues.

Dollar cost averaging out performs a typical lump sum investing strategy (the investment amount is made all at once) because only a fraction of the total amount to be invested is exposed to declines in the market. In addition when the market price falls, your regular investment amount will purchase more investment shares or units. Lastly dollar cost averaging provides a sound savings discipline and allows the investor to build an investment portfolio over time and benefit from the general rising trend of equity markets that has existed for over 100 years.

It should be noted that in a rising market dollar cost averaging will under perform a lump sum investment strategy, as the uninvested capital will not receive the same capital growth. This can be partially offset by utilising higher income savings accounts as detailed in the next strategy.

Retaining higher cash balance and utilising higher income on savings rates and or use term deposits

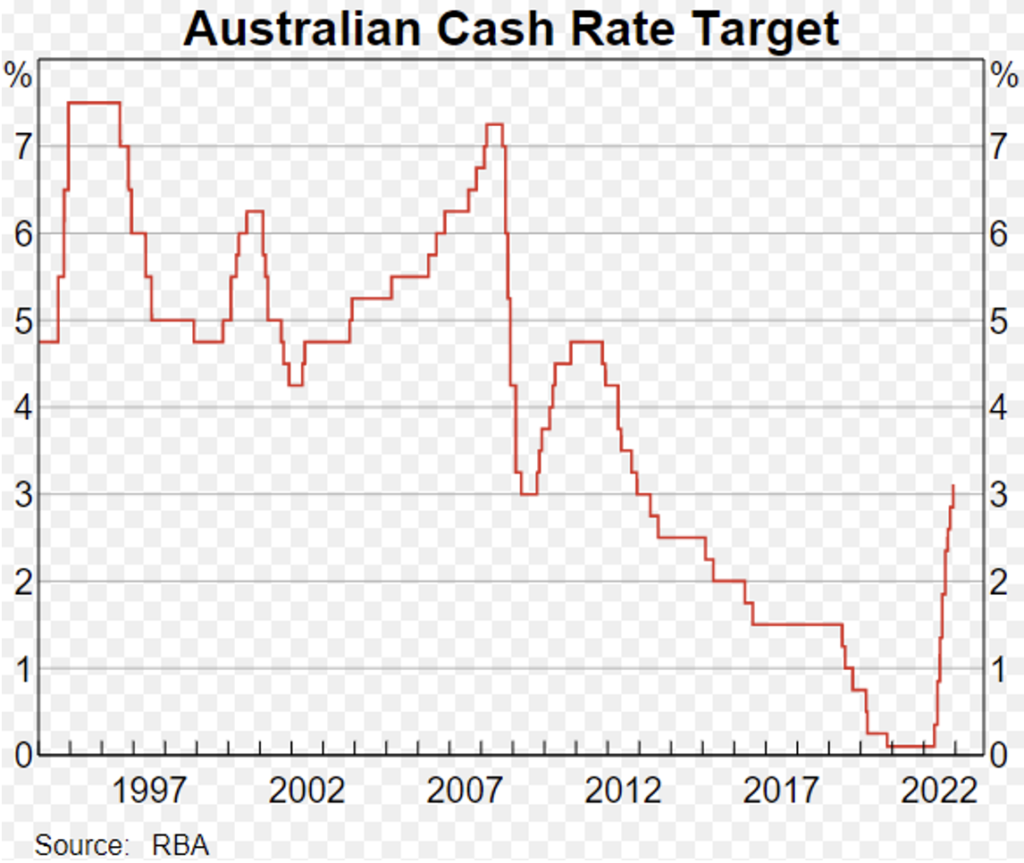

Global interest rates in the developed world have been declining for over a decade. This has resulted in cash savings earning little to no interest, and in the case of some European countries interest rates were negative (i.e. you lost money by having your money in the bank).

As mentioned one way of managing volatility is dollar cost averaging. If an investors funds are fully invested, or investing in the market is uncomfortable due to the volatility and risk of loss, a second strategy to employ is to purposely retain a lower than normal allocation to the share market. Although this will reduce the overall return, the volatility and risk of loss will also decrease.

Central banks raising interest rates has increased the potential income earned dramatically. In years following the pandemic, interest earned on cash savings accounts might have been 1% or less. Now that countries around the world are raising interest rates to fight inflation, cash interest earned has gone up 2-3 times in many cases. By retaining a higher cash balance, it is no longer the case of giving up on a return entirely. Thus an investor does not need to be fully invested all the time and can alter their exposure based on their risk tolerance and return objectives.

Focus on your controllables, budget and retain an adequate safety net

When portfolio values, and income generation is volatile, it can be helpful to focus on what you can control. You can’t control the return and income from your investments. You can however control how much you spend, how much you save, and putting money aside for unforeseen expenses. It is typically a good idea to have at least 3 months of livings expenses in savings, but of course the more the better. The larger your emergency savings are, the more financial freedom you achieve as no matter what happens you have a back stop to pay for your living needs such as food, rent/mortgage, phone, and general lifestyle.

You can extend this concept further and aim to build up a multiyear buffer, making your household financially resilient to most economic and health cost shocks. This in turn will allow you to optimise the return of your remaining investible capital in line with your risk profile and return objectives. Once you have established your buffer, you can implement the dollar cost averaging strategy to continually build wealth over time.

Revisit your investment thesis and projections and lengthen your time horizon to shut out the noise

The last strategy I’ll cover in this article is to take a step back and think about your long-term thesis, projections and objectives of your investments. A lot of investing can revolve around the latest investment trend, last nights market move, or what was on the front page of the newspaper. It is very important to always consider why you are investing in a certain investment, what your return expectations are, and at what point would you to exit (could be a price or a fundamental reason).

Taking this approach to your existing investments, will help you cut positions that aren’t meeting your criteria. Typically, losers continue to drag on performance while you await the fabled ‘turnaround’ and winners are either cut short, or profit is never taken. Creating rules around your entry point, exit point, and position sizing are crucial to help manage your investments in volatile and uncertain times.

In summation, the future is always uncertain, and 2023 looks to be a year of changing trends and thematics. Strategies like dollar cost averaging, and reducing overall equity exposure in favour of more certain income will reduce the overall volatility of your portfolio and now that interest on savings have increased the overall return of your investments is not as detrimentally affected. Focussing on your controllables like a personal budget and savings plan, but also your investment thesis and process should be able to help you protect, build and compound through what looks to be a challenging year to come.

Accru is an award winning mid-tier financial services firm that provides a range of accounting, audit, taxation, advisory and financial planning services Please contact your local Accru advisor to discuss any matters you feel Accru can assist you with.

"

"