Relevant to all entities

Standard effective for the first time for December 2022 reporters

The good news is that there is only one new standard which is newly effective for 31 December 2022 reporters, and it is not expected to have significant impact for most entities although it does include changes to a number of standards.

AASB 2020-3 Amendments to Australian Accounting Standards – Annual Improvements 2018-2020 and Other Amendments amends the following standards for principally minor or editorial changes as follows:

- AASB 1 First Time Adoption of Australian Accounting Standards – guidance relating to measurement of cumulative translation differences where a subsidiary is a first-time adopter after its parent

- AASB 3 Business Combinations – editorial amendment

- AASB 9 Financial Instruments – relates to fees incurred when considering a modified financial liability

- AASB 116 Property, Plant and Equipment – sales proceeds (and associated expenses) from selling items produced prior to PPE being ready for its intended use is recognised as through profit or loss

- AASB 137 Provisions, Contingent Liabilities and Contingent Assets – specifies the costs to include when assessing whether a contract is loss-making and

- AASB 141 Agriculture – Removes the requirement to exclude cash flows from taxation when measuring fair value.

New standard not yet effective but may be considered for early adoption

A new standard issued by the IASB will allow certain loans to be classified as non-current rather than the current classification.

The standard requires only covenants which are to be tested on or before the reporting period to be considered when classifying liabilities.

For example:

An entity has a 5 year loan which expires in June 2027 which contains liquidity covenants based on the entities balance sheet at 30 June each year although the bank ensures compliance when they receive the financial statements in September. The bank agreement allows the bank to perform an annual review of the loan to determine whether the loan continues to be appropriate and in their risk profile.

Assuming that the entity has complied with the covenants at 30 June then the loan can be classified as non-current in the 30 June financial statements regardless of the existence of any annual review clauses relating to future adverse occurrences at the entity which may be in the agreement.

This means that some loans that have previously been classified as current are now re-classified as non-current for the current year and comparatives.

Relevant to for-profit entities preparing special purpose financial statements

New disclosure requirements for certain for-profit special purpose financial statements

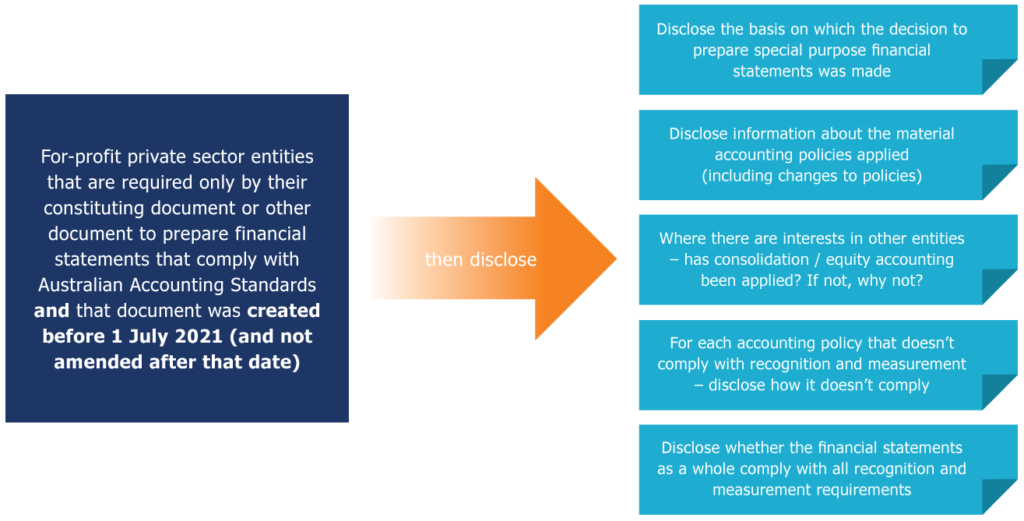

For-profit entities who continue to choose to prepare special purpose financial statements using the AASB grandfathering provisions relating to the creation or amendment date of their constitution or other document requiring preparation of financial statements in accordance with Australian Accounting Standards will have to include additional disclosures in their financial statements from 30 June 2022.

These additional disclosures are illustrated below:

Note: entities can amend their constituting and other document to remove the requirement to prepare financial statements in accordance with Australian Accounting Standards if they do not want to prepare these disclosures.

Relevant to entities registered under the Corporations Act 2001

Treasury activity

Grandfathering provisions within the Corporations Act 2001 provided an exemption to certain companies from lodging their financial statements with ASIC.

In August 2022, the Corporations Act was amended to remove grandfathering and therefore for financial years ending on or after 10 August 2022, previously grandfathered companies will have to lodge their general purpose financial statements.

Be aware of that if any of these companies took advantage of the extension at prepare and audit their financial statements at 30 June 2022 then the grandfathering was lost for that financial year.

Relevant to all NFP entities

AASB proposals to simplify accounting requirements for certain NFP entities

The AASB has released proposals to simplify accounting requirements for certain NFP entities through a third tier of accounting standards – the actual entities who would be able to adopt the standards will be determined by the legislators however the AASB used the ACNC medium sized charities as their benchmark when developing the proposals.

Some of the key aspects of the proposal are shown in the diagram below, in particular we draw the reader’s attention to the proposals relating to leases (recognised as expense) and revenue (recognised when expenses are incurred if there is a common understanding of how the funds will be spent).

We believe that these two proposals alone significantly simplifying the current Accounting Standards requirements and encourage you to review the AASB document and complete the online survey so we can ensure that the voice of as many NFP preparers and advisors are heard.

Further information and how to provide feedback?

The AASB has released a snapshot document of the proposals which is an easy read (available here) and a survey to capture views and opinions quickly and easily (available https://www.surveymonkey.com/r/AASBTIER3NFP ). There are also a number of outreach sessions being held both virtually and face-to-face and information can be found at this link.

AASB post-implementation reviews

The AASB is also seeking feedback on the performance of some of the domestic accounting standards through the post-implementation review (PIR) process, the Invitation to Comment document include known issues or concern with existing standards and provide an opportunity to comment on these issues or others which have not been identified.

The relevant standards are:

- Income of Not-for-Profit Entities – AASB 1058 and Appendix F of AASB 15

- Control and consolidation – Appendix H of AASB 10

- Structured entities – AASB 12

- Disclosures in special purpose financial statements – AASB 1054

- Related party disclosures (public sector only) – AASB 124

The PIR documents are available on the AASB website.

Relevant to NFP entities registered with the Australian Charities and NFP Commission (ACNC)

Disclosure of related party transactions

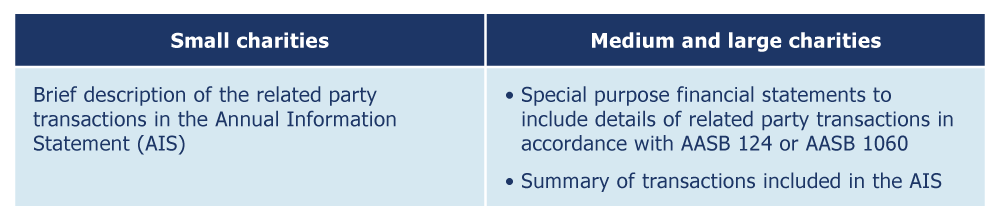

In addition to the ACNC requirements to report Key Management Personnel (KMP) in financial statements for 30 June 2022 (refer May 2022 edition), ACNC registered entities will have to report information on related party transactions from 30 June 2023.

The nature and extent of disclosures vary depending on the small of the charity as illustrated in the table below:

Entities should consider these disclosures as soon as possible to ensure that they have appropriate processes in place to collect the relevant information, note that any related party transactions during the financial year are included.

Choice of disclosures for special purpose financial statements lodged with ACNC

The ACNC has announced a choice for registered charities in relation to the disclosures included in their special purpose financial statements.

From 30 June 2023, the special purpose financial statements should comply with the disclosure requirements of either:

- The specified standards, being:

- AASB 101 Presentation of Financial Statements

- AASB 107 Statement of Cashflows

- AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors

- AASB 124 Related Party Disclosures

- AASB 1048 Interpretation of Standards and

- AASB 1054 Australian Additional Disclosures OR

- AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities in its entirety.

If you are affected or have questions on any of the areas covered in this update, please reach out to your local Accru contact.

"

"