We are pleased to present the November 2023 edition of our Financial Reporting Update, in this edition we will discuss the new standards effective for the first time on 31 December 2023 (also relevant for 30 June 2024), the ACNC report on charity financial statements, the key findings from ASIC’s latest surveillance work and an overview of the latest happenings in the sustainability disclosure world.

New standards – Does anyone read your accounting policies?

There are a few accounting standards which are relevant for the first time for our 31 December 2023 and 30 June 2024 reporting periods, however the one that is likely to see the most impact for the majority of our clients relates to accounting policies.

Accounting policies often consume considerable space in our current financial statements and are commonly carried forward year after year with minimal changes. This practice can lead to the inclusion of outdated or irrelevant information, and unfortunately, these sections tend to be overlooked by a significant number of users and stakeholders.

As part of their projects to try to make financial statements more meaningful and remove immaterial information, AASB 2021-2 Amendments to Australian Accounting Standards – Disclosure of Accounting Policies and Definition of Accounting Estimates (AASB 2021-6 Tier 2 equivalent) introduce the requirement to disclose material accounting policy information only which should result in most of the words in the accounting policy sections being removed from financial statements.

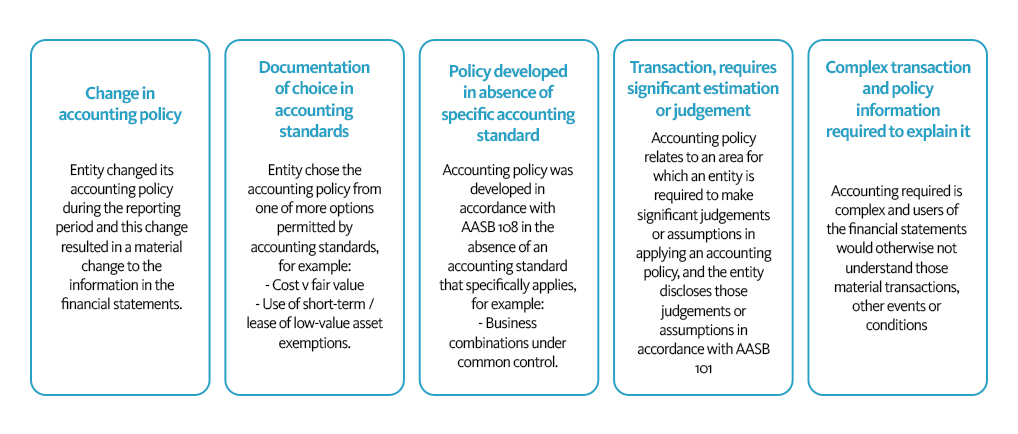

The standards note that accounting policy information likely to be material if it relates to material transactions, other events or conditions AND meets one of the following:

We strongly advise our clients to review their accounting policies in light of the revised requirements set out in AASB 2021-2, and to consider removing any elements that do not contribute material accounting policy information, ensuring clarity and relevance in their financial reporting. Your Accru advisor or auditor would be pleased to examine your template financial statements prior to the year-end, ensuring that we are in agreement with the proposed changes.

Other standards to consider for your next reporting season:

- AASB 2021-5 Amendments to Australian Accounting Standards – Deferred Tax related to Assets and Liabilities arising from a Single Transaction

Clarifies that the exemption from recognising deferred tax does not apply to transactions for which entities recognise both an asset and a liability and that give rise to equal taxable and deductible temporary differences

- Impact: deferred tax likely to be recognised on lease and decommissioning and similar provisions (including lease make-good)

- AASB 17 Insurance Contracts (and associated standards) – Don’t forget this has impact for non-insurance companies, in particular warranties, financial guarantees and fixed fee service contracts – refer to the May 2023 edition for detailed information on this standard.

- AASB 2023-2 Amendments to Australian Accounting Standards – International Tax Reform – Pillar Two Model Rules (and associated Tier 2 standard (AASB 2023-4))

- Relevant for entities affected by the implementation of the Pillar Two Model rules published by the Organisation for Economic Co-operation and Development

- AASB 2022-7 Editorial Corrections to Australian Accounting Standards and Repeal of Superseded and Redundant Standards – administrative standard only, therefore no impact for entities.

ACNC Charities Report

The ACNC has released their latest review of Annual Information Statements and Financial Reports which covered 250 Annual Information Statements (AIS) and financial reports submitted between July 2021 and December 2022.

The report includes some improvements which could be made to both AIS and financial reports and we encourage our Charity clients to review this report to ensure that the common errors are not occurring in their documents. We note that there has been changes to accounting standards and other requirements recently, including that medium and large charities are required to disclose related party transactions in their financial statements from 30 June 2023 (refer to the May 2023 newsletter).

Some relevant findings from the report include:

- 79% of financial report identified the ACNC Act as relevant financial reporting framework (reminder the ACNC Regulations were updated in 2022)

- 74% of financial report contained a complete set of financial statements (refer below)15% of charities incorrectly presented expenses using a mixture of nature and function (46% nature, 39% function)Disclosures lacking:

- Whether the entity was a for-profit or not-for-profit for financial reporting purposesAccounting estimates and judgements appliedFees paid to auditor / reviewer of the financial statements.

- 10% of auditor reports contained a modified opinion.

- 74% of financial report contained a complete set of financial statements (refer below)15% of charities incorrectly presented expenses using a mixture of nature and function (46% nature, 39% function)Disclosures lacking:

ASIC Surveillance Findings

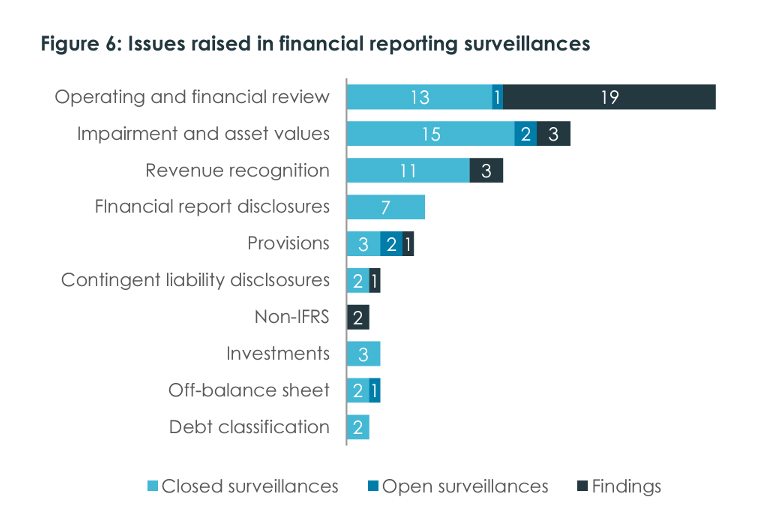

In October 2023, ASIC released their first integrated financial reporting and audit surveillance report (REP 774) which includes the results of their review of 180 financial reports of ASX-listed and other large unlisted entities as well as 15 related audit files for the period 1 July 2022 to 30 June 2023.

Whilst a number of queries were raised to entities by ASIC, there were 25 findings across a range of areas as shown in the diagram below (included as figure 6 in ASIC’s report).

These areas of concern are consistent with those from previous years. We urge our clients to carefully evaluate their accounting policies, particularly focusing on aspects relevant to their operations, such as revenue recognition, impairment assessments, and control of investments within their group structure.

Focus Topic: Sustainability Reporting

Our focus topic for this edition is sustainability with a particular emphasis on climate related risks and opportunities. This is a rapidly evolving area and entities need to be aware of these changes not only to understand their reporting obligations and also the reporting of those entities within their value chain since they may receive requests to provide information to them.

There are three key developments which have occurred in the last six months and whilst some of the consultations are ongoing, it is important for entities to stay information about the latest thinking.

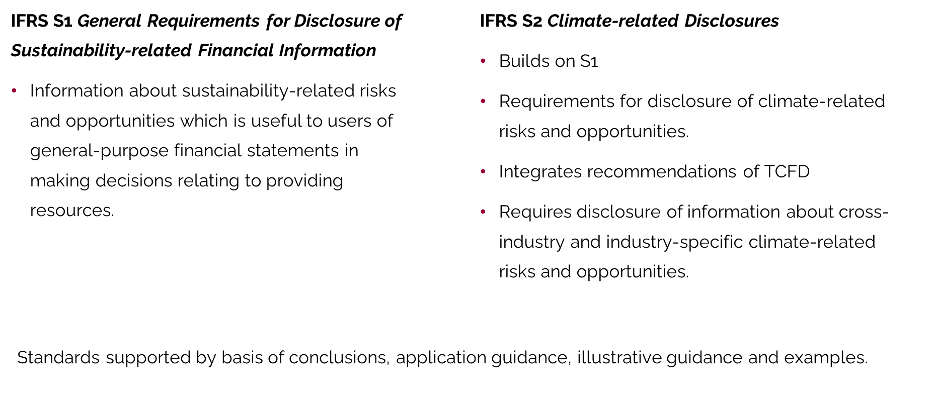

The International Sustainability Standards Board (ISSB), the sister body to the International Accounting Standards Board (IASB) has released their first two standards. This ISSB aims to develop a high-quality, comprehensive baseline of sustainability disclosures focused on the needs of investors and financial markets.

As noted below, Australia is proposing to use the ISSB as the base for the Australian entities.

The two standards released are:

The Federal Department of Treasury (Treasury) is the entity who will determine the who and when for entities which it manages (i.e., companies and registered charities), other legislators will perform this role for their relevant entities.

Treasury have undertaken two consultations on the implementation of climate-related risks and opportunities in Australia to assist them in making policy decisions.

The second consultation proposes that the focus in Australia will be climate reporting rather than general sustainability disclosures and that mandatory climate reporting will be required for the following entities:

| Entity | Mandatory reporting date |

| Chapter 2M1 and either: (1) Meets 2 out of 3: – More than 500 employees – Consolidated gross assets > $1bn – Consolidated revenue > $500m | Annual reporting periods beginning on or after 1 July 2024 (i.e., 30 June 2025 onwards) |

| Chapter 2M1 and either (1) Meets 2 out of 3: – More than 250 employees – Consolidated gross assets > $500m – Consolidated revenue > $200m | Annual reporting periods beginning on or after 1 July 2026 (i.e., 30 June 2027 onwards) |

| Chapter 2M1 and either: (1) Meets 2 out of 3: – More than 100 employees – Consolidated gross assets > $25m – Consolidated revenue > $50m This will capture all large proprietary companies. | Annual reporting periods beginning on or after 1 July 2027 (i.e., 30 June 2028 onwards) |

Note that chapter 2M entities under the National Greenhouse and Energy Reform Act (NGER) who are controlling corporations and meet the NGER publication threshold will be included in tranche one with all other controlling corporations under the NGER Act being included in tranche three.

1 References to Chapter 2M relate to companies who are regulated under Chapter 2M of the Corporations Act 2001.

Treasury will hopefully finalise their position in the near future, so entities have some certainty about who has to comply and the relevant timeframes.

In November 2023, the Australian Accounting Standards Board (AASB) released EDSR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information which comprises of:

- ASRS 1 General Requirements for Disclosure of Climate-related Financial Information – uses IFRS S1 as baseline but with scope limitation to climate-related financial disclosure

- ASRS 2 Climate-related Financial Disclosures – uses IFRS S2 as baseline

- ASRS 101 References in Australian Sustainability Reporting Standards – service standard which lists non-legislative documents that are referenced in ASRS Standards.

Once the comments have been collated, the AASB will issue Sustainability Reporting Standards which entities in Australia will have to comply with.

The comment period is open until 1 March 2024 and the AASB are extremely keen to receive as much feedback as possible which can be provided in a range of ways:

- Completion of an online survey (https://www.surveymonkey.com/r/AASBEDSR1)

- Attendance at AASB roundtable (details on AASB website)

- Submission of formal comment letter.

It is important to remember that even if you don’t have direct mandatory reporting requirements under these standards, many entities may have to collate this information due to:

- Requests from partners in their value chain

- Requirements from overseas parents.

If you want any more information on any of the topics discussed in this article or to discuss the application to your specific circumstances, please get in touch with your local Accru representative.

"

"