In a bid to aid business growth and innovation as well as create more jobs for Australians, the Government plans to reduce the corporate tax rate for small business over the next decade.

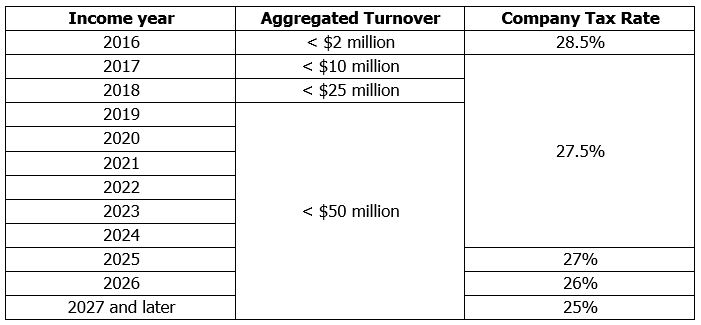

The good news for small to mid-sized Australian businesses is that an increasing number of them will become eligible for more tax cuts over the next decade than under the current legislation. Here’s our timeline summarising when the proposed tax cuts will be introduced.

Tax cuts and concessions

For the 2015/2016 financial year

Under pre-existing legislation, the corporate tax rate for SBEs was reduced from 30% to 28.5%. This applied to companies carrying on a business for all or part of an income year with a current or prior year’s aggregated turnover of less than $2 million.

For the 2016/2017 financial year

New legislation will be passed to increase the aggregated turnover threshold of SBEs to, in most cases, less than $10 million (in the current or prior year). The corporate tax rate will also be reduced further to 27.5% for these companies. In addition, the legislation will make various tax concessions, such as SBE depreciation, available to a wider range of companies. It is important to note the Small Business CGT Concessions and Small Business Income Tax offset will remain unchanged from their current eligibility requirements.

From the 2017/2018 financial year

The reduced corporate tax rate of 27.5% will extend to other companies that are ‘Base Rate Entities’ (BREs). A Base Rate Entity is one that carries on a business and meets the aggregated turnover threshold for the specific year. For the 2017/2018 financial year, this threshold is less than $25 million. From the 2018/2019 financial year, this threshold will increase to less than $50 million.

Between 2025 and 2027

The corporate tax rate for Base Rate Entities will decrease further from 27.5% to 25%. For all other companies above these thresholds and non-business company structures (such as an investment company or bucket company), the corporate tax rate will remain at 30%.

Franking credits

For the 2015/2016 financial year, the franking credits attached to frankable distributions remained at 30%. However, from 1 July 2016, the legislation will align the maximum franking credit that can be allocated to a frankable distribution to the tax rate applicable to the company paying the distribution. These changes have not yet received royal assent, however there are unlikely to be any issues.

Changes to the corporate tax rate for SBEs and BREs

By Kelly Spence, Accru Rawsons Brisbane